Company deep-dive no 5: Adobe

Adobe has experienced notable stock volatility since late '21, and has now (almost) fully recovered - is it a buy at current prices? And is Adobe losing its competitive edge?

Since Shantanu Narayen steered Adobe towards a cloud-based, service-oriented business model in 2013, the company has seen remarkable growth. This shift from selling packaged software to offering software as a service (SaaS) has been a key growth driver, reflected in a substantial 2,629% rise in its share price over a similar timeframe. However, Adobe's stock did encounter a slump in 2021, largely attributed to rising inflation and interest rates. The situation was further impacted by Adobe's then-proposed $20 billion acquisition of Figma, which was a significant factor in this decline. Nonetheless, this deal was later called off by competition authorities in mid-December 2023 due to regulatory concerns. Most recently, Adobe experienced a sell-off due to OpenAI’s Dall-E which according to news sent a ‘shock wave of panic’ through Adobe.

Despite these market fluctuations, Adobe has maintained a strong market presence and financial stability, underlining the resilience and effectiveness of its business model. This has continued to inspire confidence among long-term investors. That said, investors are becoming increasingly concerned about declining topline growth rates and whether Adobe has lost it.

This deep-dive aims to dissect Adobe's corporate journey, shedding light on the pivotal elements that have cemented its robust position in the market, and which short- and long-term challenges Adobe is currently facing. This information will then be used to value Adobe from different perspectives, to assess whether the company is attractive at current prices.

Introduction

Adobe Inc. is a renowned leader in the software industry, widely recognized for its extensive range of products and services that cater to graphic design, video editing, web development, photography, and more. Founded in December 1982 by John Warnock and Charles Geschke in Mountain View, California, Adobe has significantly shaped the evolution of digital media and content creation.

The company's first product, Adobe PostScript, was a revolutionary technology that transformed the publishing industry by enabling text and images to be printed on the same page. This innovation laid the foundation for the company's future success. Adobe's portfolio rapidly expanded with the introduction of iconic software such as Adobe Photoshop for image editing, Adobe Illustrator for vector graphics, and Adobe Acrobat with its universally used PDF format.

In recent years, Adobe has transitioned successfully from a traditional software-selling model to a cloud-based subscription service, offering its suite of software through the Adobe Creative Cloud. This shift not only modernised its business approach but also provided users with more accessible and updated tools. The company has also ventured into digital marketing software with Adobe Experience Cloud, offering comprehensive tools for analytics, advertising, and e-commerce.

Adobe's impact on the digital world is undeniable. From professional designers and photographers to casual users and students, Adobe's software has become essential in various fields of digital creativity and communication. The company's commitment to innovation, quality, and user-centric design continues to drive its success and influence across multiple industries.

Adobe trades under ADBE. As of 19th February 2024, Adobe has a market cap of $247.09 billion. This makes Adobe the world's 42nd most valuable company by market cap, in between Hermès and Reliance Industries.

This deep-dive has the following chapters:

Adobe’s segments

Adobe’s business model and growth strategy

Adobe’s competitors

Review of Adobe CEO: Shantanu Narayen

Adobe’s moats

Adobe’s financial performance

Capital Allocation

Adobe valuation

Technical analysis of Adobe

Adobe’s short- and long-term challenges

Adobe’s opportunities going forward

Final remarks

1. Adobe’s segments

Adobe's like a Swiss Army knife in the digital world, offering a little bit of everything for everyone, spread across a few key areas.

First up, there's the Digital Media side of things, where Adobe really shines. This is where all the creative magic happens. Think of Adobe's Creative Cloud, which is like a treasure chest for artists, photographers, and designers, packed with gems like Photoshop, Illustrator, and Premiere Pro. Then, there's the Document Cloud, which is all about PDFs and documents. Adobe Acrobat lives here, making peoples’ lives easier by letting them create, tweak, and share PDFs in a snap.

Then we have the Digital Experience segment, which is Adobe's playground for businesses and marketers. It's a powerhouse for managing digital marketing, from crunching data in Adobe Analytics to jazzing up customer experiences with Adobe Experience Cloud. And for those in the e-commerce game, Adobe Commerce, known as Magento, helps businesses set up and run online stores.

Adobe also has its foot in the Publishing and Advertising door, catering to the more technical side of things. This includes Adobe Connect for web conferencing and Adobe FrameMaker for creating awesome technical documents and content.

And let's not forget, Adobe's always peeking into the future, dabbling in AI and machine learning with Adobe Sensei to make its tools smarter and diving into the 3D and immersive content world, staying ahead of the tech curve.

So, Adobe's pretty much got a tool or service for anyone looking to create, manage, market, or just play around in the digital universe.

2. Adobe’s business model and growth strategy

Adobe's business strategy cleverly adapts to the evolving digital landscape. They've shifted from traditional software sales to a subscription model, a move that’s proved to be a masterstroke. This approach ensures a consistent revenue stream, as customers pay periodically for access to tools like Photoshop and Acrobat. It’s a strategy that not only stabilizes income but also keeps users engaged with continuous updates. See below subscriber development in period 2013-2024:

Furthermore, innovation is at the heart of Adobe’s ethos. They are constantly refining their offerings, integrating advanced technologies like AI and machine learning with Adobe Sensei. This commitment to innovation keeps their software portfolio cutting-edge and highly efficient. Adobe’s range is vast, covering everything from graphic design to digital marketing, catering to a diverse array of users.

Expanding its market reach is a key part of Adobe’s strategy. They’re not just spreading geographically, but also diversifying their target audience, from individual creatives to large enterprises. Adobe’s not shy about acquisitions either – bringing companies like Magento and Marketo into its fold has significantly broadened its capabilities in e-commerce and digital marketing.

Partnerships play a crucial role in Adobe’s growth. Collaborating with other tech leaders and nurturing an ecosystem around its products allows Adobe to widen its influence and offer more integrated solutions. Additionally, Adobe places a strong emphasis on education and community. By offering educational discounts and fostering a community around its products, Adobe builds a dedicated and loyal user base from the ground up.

Adobe announced in September 2022 its intention to acquire Figma, a popular web-based interface design tool, for $20 billion. Figma is renowned for its collaborative interface design tools, which are highly popular among UX/UI designers. The acquisition would significantly bolster Adobe's offerings in web and app design, complementing its existing tools like Adobe XD. Adobe's plan to acquire Figma has been called off. This decision came after significant pushback from regulatory authorities in Europe over antitrust concerns. The UK's Competition and Markets Authority (CMA) and the European Commission both expressed worries that the merger would significantly hamper competition in the market for design software. They were particularly concerned about the potential impact on interactive product design software and other creative design tools, including vector and raster editing tools. As part of the termination agreement, Adobe was required to pay Figma a $1 billion termination fee. Despite the setback, Adobe expressed its intention to continue exploring ways to partner with Figma in the future.

To sum up, Adobe’s strategy is a blend of being indispensable, innovative, and forward-thinking. They’re not just selling software; they’re embedding themselves into the fabric of the digital creative and marketing world.

3. Adobe’s competitors

Adobe, in the vast landscape of technology, commands a formidable presence in several key areas. In the realm of creative software, with products like Photoshop and Illustrator, Adobe stands as a towering figure. Its software has become synonymous with professional graphic design, photography, and digital art. While there are notable alternatives like CorelDRAW, Affinity, and the increasingly popular Canva, Adobe continues to hold a strong leadership position.

When we shift focus to PDFs and document management, Adobe Acrobat emerges as a prominent name. Despite facing competition from Foxit, Nitro, and DocuSign, Adobe's Acrobat has entrenched itself deeply in both professional and personal usage spheres, thanks to its comprehensive features and seamless integration.

However, the scenario is more competitive in digital marketing and analytics. Adobe Analytics operates in a field where Google Analytics dominates due to its free accessibility and integration with Google's vast suite. In this broader marketing domain, industry giants such as Salesforce and Oracle also provide stiff competition, creating a dynamic and challenging environment.

In the video editing sector, Adobe’s offerings, Premiere Pro and After Effects, are highly regarded, especially by professionals. Nevertheless, this market segment witnesses robust competition from Apple's Final Cut Pro, a favorite among Mac users, and DaVinci Resolve, renowned for its superior color grading capabilities. Adobe holds a significant place here but shares the stage with other influential players.

In web development and design, the landscape is diverse and competitive. Adobe's tools like XD and Dreamweaver are part of a broad spectrum that includes Sketch, Webflow, and WordPress. Here, Adobe is making strides, especially with XD in the UX/UI design community, yet it’s a segment with no clear dominator.

As for the 3D and AR creation tools, Adobe is an important participant but not the market leader. Specialized companies like Autodesk and Unity lead this niche, though Adobe is making notable advances, particularly in augmented reality.

Below is a snapshot of closest listed peers’ market cap as of 15-02-2024:

In summary, Adobe is a multifaceted entity in the tech world. It reigns supreme in creative software and PDF tools, competes vigorously in video editing, and is actively expanding its influence in other sectors. This dynamic interplay with competitors exemplifies the ever-evolving nature of the technology industry.

4. Review of Adobe CEO: Shantanu Narayen

Shantanu Narayen stands out as the Chairman, President, and CEO of Adobe Inc., playing a transformative role since 1998. His strategic vision evolved Adobe from a traditional software vendor to a powerhouse in digital media and digital marketing solutions. Before becoming CEO in December 2007, Narayen's leadership at Adobe was marked by a shift from the Creative Suite products to a more profitable cloud-based subscription model, expanding the company's market and financial footprint.

Narayen's diverse background includes co-founding Pictra Inc., a pioneer in digital photo sharing, and holding key roles at Apple and Silicon Graphics. His global recognition includes an appointment to the President's Management Advisory Board by President Obama and a notable educational background from the University of California, Berkeley. Narayen's leadership at Adobe is characterized by a visionary approach and a relentless drive for innovation. He adeptly led Adobe's transition to cloud-based services, significantly enhancing its market position and financial performance. His customer-centric strategy ensures that Adobe's offerings are not only innovative but also directly meet customer needs.

His global perspective fosters an inclusive corporate culture and guides Adobe's expansion, with a strategic approach to acquisitions that strengthens the company's industry position. Employee empowerment and financial acumen are also central to his management style, contributing to Adobe's growth and the successful shift to a subscription model. Beyond corporate performance, Narayen emphasizes sustainability and corporate responsibility, highlighting his holistic and adaptable leadership style. His personal investment in Adobe's success is evident, holding around 378,121 shares (worth over $231 million), aligning his interests closely with the company's performance and shareholder value. Hugely positive that Shantanu Narayen has his skin in the game.

5. Adobe’s moats

Adobe's competitive advantages, or "moats" in Warren Buffett's terminology, are several key factors that have contributed to its strong market position:

Brand Recognition and Loyalty: Adobe has established a powerful brand, especially within the creative industry. Products like Photoshop and Illustrator have become industry standards, synonymous with their respective functions. This strong brand recognition has fostered considerable customer loyalty.

High Switching Costs: Adobe's comprehensive suite of interconnected tools creates a high switching cost for users. Professionals who have invested time and resources in learning Adobe’s software are less likely to switch to competitors, as doing so would require retraining and adapting to a new workflow.

Network Effects and Community: Adobe benefits from network effects, as the widespread adoption of its software creates a de facto standard in the industry. This effect is amplified by the vibrant community of users who share resources, tutorials, and templates, making the platform more valuable.

Diversified Product Offering: Adobe's diverse range of products in digital media, digital marketing, and document management allows it to cater to a wide array of customer needs, reducing its dependency on any single product or market.

Innovation and R&D Investment: Adobe has consistently invested in research and development to innovate and stay ahead of the curve. The integration of AI and machine learning through Adobe Sensei demonstrates its commitment to continuous improvement and staying at the forefront of technology. Average R&D spending as percentage of gross profits has been 20% since 2013.

Subscription-Based Business Model: The shift to a subscription-based model has provided Adobe with a steady, predictable revenue stream. This model ensures that users always have access to the latest updates and features, improving customer satisfaction and retention.

Strategic Acquisitions: Adobe has strategically acquired companies to expand its capabilities and enter new markets. These acquisitions have allowed Adobe to stay relevant and competitive in a rapidly evolving digital landscape. The huge amount of cash flows generated each year and the vast amount of cash on their books serve as dry powder for future acquisitions.

Global Reach and Scalability: Adobe's global presence and the scalability of its cloud-based services allow it to serve a wide and growing customer base, from individual creatives to large enterprises.

These competitive advantages have helped Adobe build a strong, sustainable business that can weather market changes and maintain a leading position in its industry.

6. Adobe’s financial performance

Historically, Adobe's financial performance has been marked by strong growth and resilience, characterized by several key phases and strategic shifts:

Early Growth (1982–1999): Adobe's initial success came from the desktop publishing revolution, with products like PostScript and Adobe Illustrator defining the market. This period was marked by steady growth as Adobe established itself as a major player in the software industry.

Expansion and Diversification (2000–2007): Adobe expanded its product portfolio through significant acquisitions, including the purchase of Macromedia in 2005, which brought in products like Flash and Dreamweaver. This period saw Adobe strengthening its position in various market segments, including graphic design, web development, and video editing.

Economic Challenges (2007–2012): Like many companies, Adobe faced challenges during the global financial crisis. However, the company managed to navigate this period with a focus on innovation and by starting to shift towards a subscription-based model.

Transformation to Subscription Model (2013–present): Adobe's decision to transition to a cloud-based subscription model with the introduction of Adobe Creative Cloud in 2013 was a pivotal moment. This shift was initially met with skepticism but ultimately proved to be highly successful. It led to a more stable and predictable revenue stream, reduced piracy, and provided customers with continuous updates and new features. Post-transition to the subscription model, Adobe has shown consistent revenue growth. The company's focus on expanding its cloud-based offerings, including the Adobe Experience Cloud for digital marketing, has allowed it to tap into new markets and revenue streams.

These phases led to the following financial performance:

Since 2013, Adobe has experienced a robust CAGR of 16.9%, primarily fuelled by its shift to a subscription-based revenue model. The past two years, Adobe has had growth rates below 10-y avg. of 17.2%. The reasons for this may be due to regulatory scrutiny over its subscription models and antitrust issues, particularly concerning its $20 billion acquisition of Figma. Additionally, the macroeconomic environment, marked by high inflation and interest rates, has led to reduced spending by individuals and firms. Adobe has also increased the prices for some of its offerings, which further dampened demand. Yet, Adobe has still experienced double-digit growth rates.

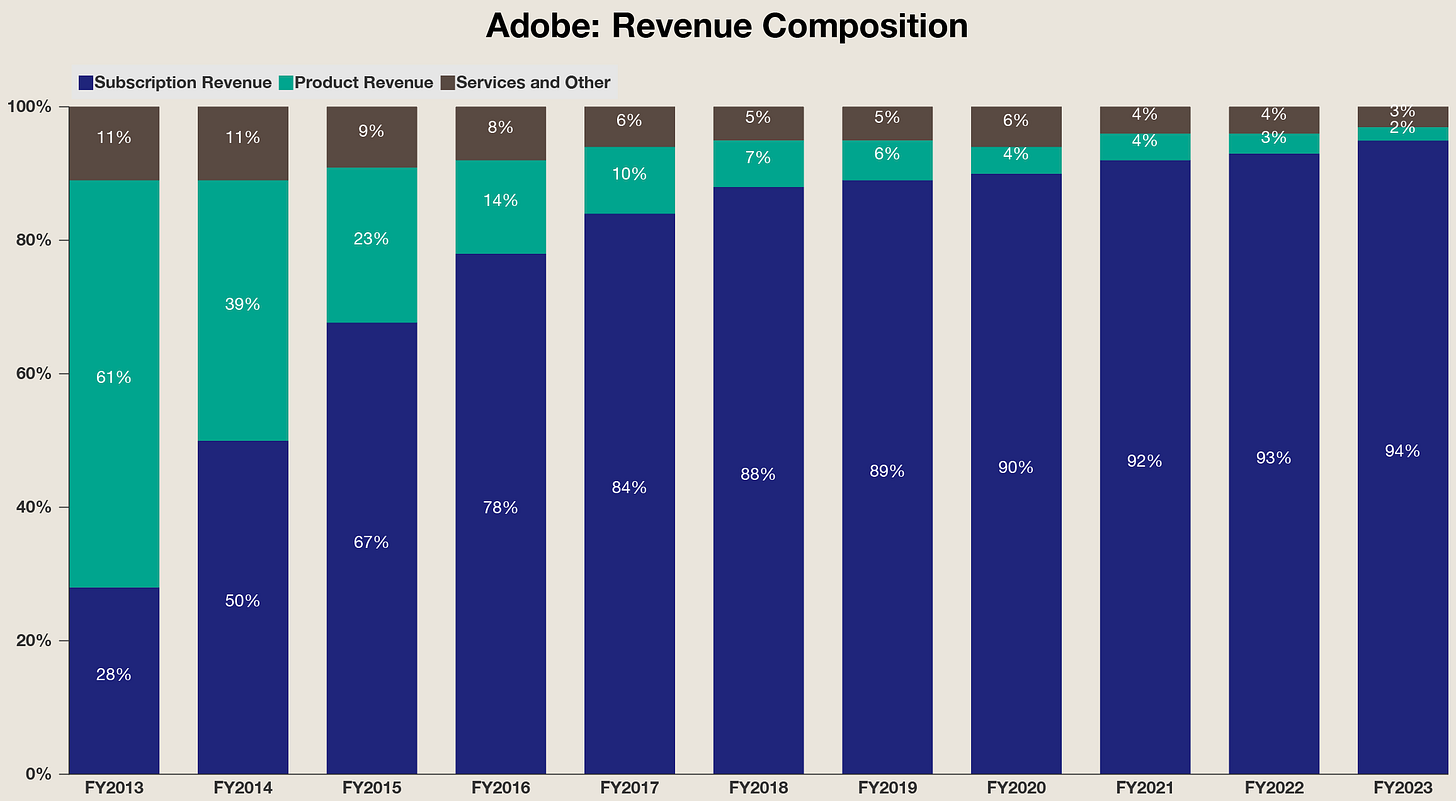

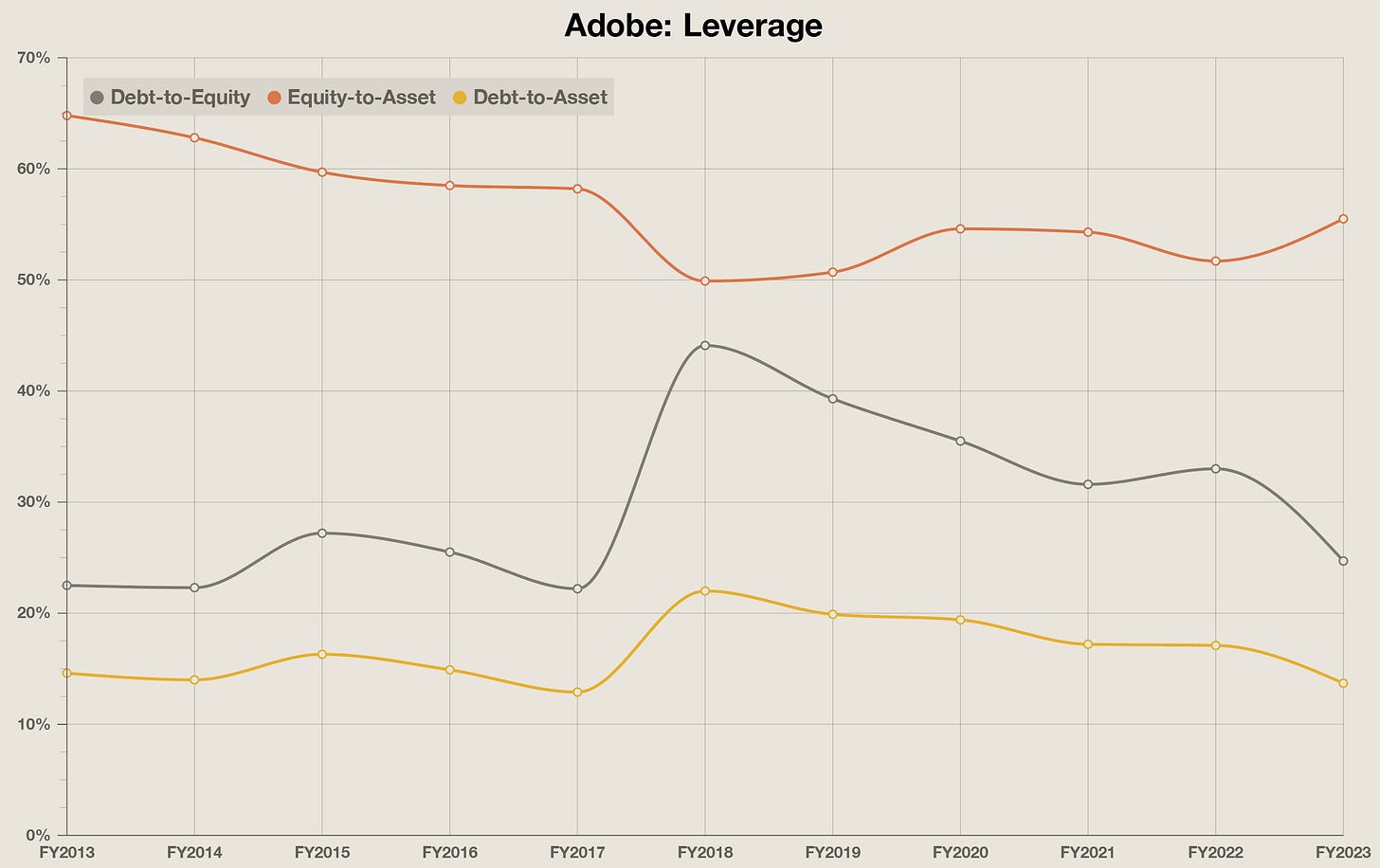

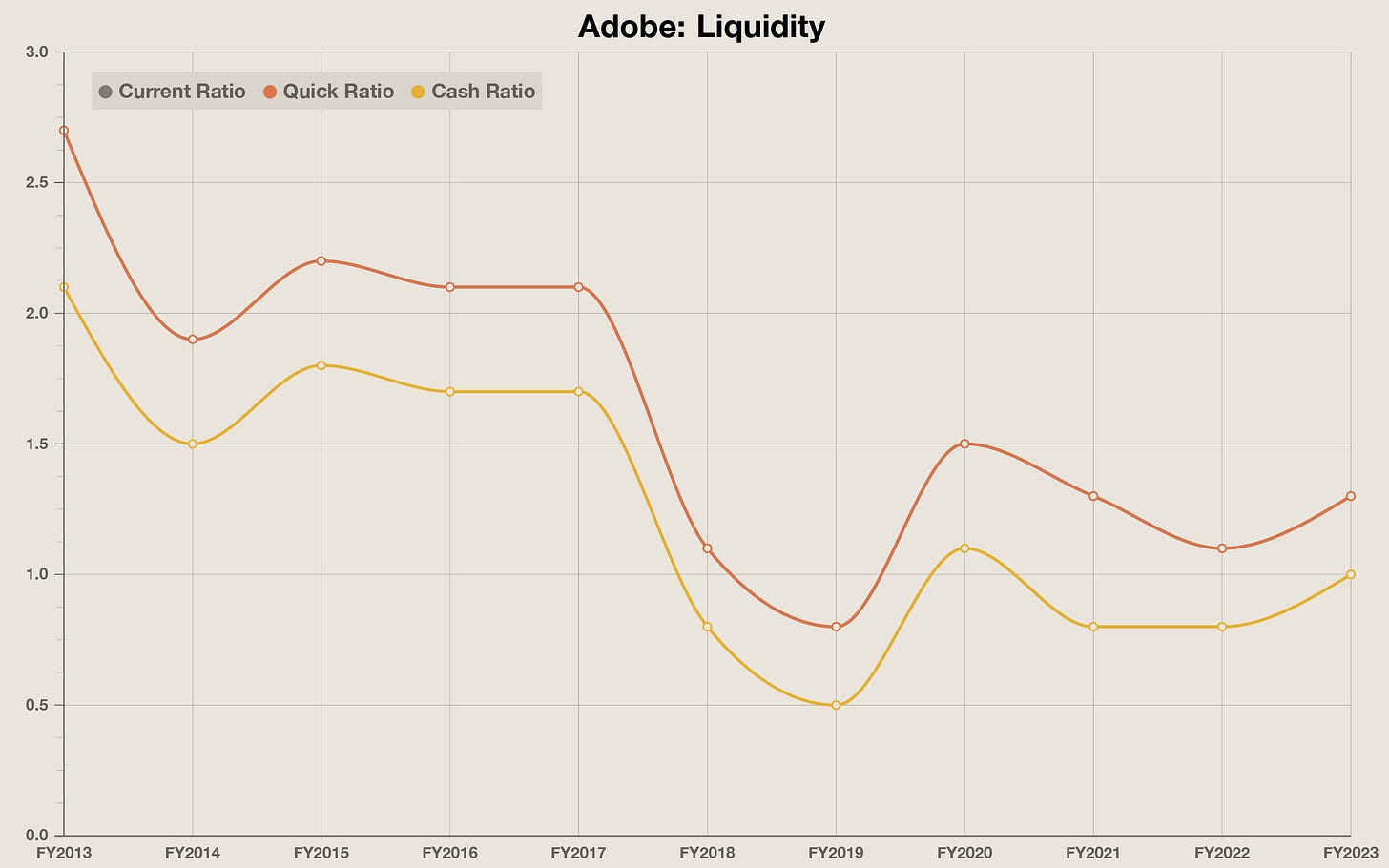

By 2023, subscription revenues made up 94% of its total revenue. This transformation has notably enhanced 'per employee' metrics, with Adobe witnessing significant increases in both revenue and EBITDA per employee, all the while effectively controlling SGA-related expenses. This meticulous approach to cost management is further reflected in their OPEX performance post-2013, showcasing a decrease in overhead costs relative to gross profit. This financial trajectory is exceptionally strong, showcasing Adobe's ability to significantly boost top-line growth while simultaneously sustaining or reducing cost levels. This robust performance is further mirrored in Adobe's expanding profit margins across the board. Additionally, Adobe has consistently maintained conservative debt levels, underlining the company's prudent financial strategy.

7. Capital Allocation

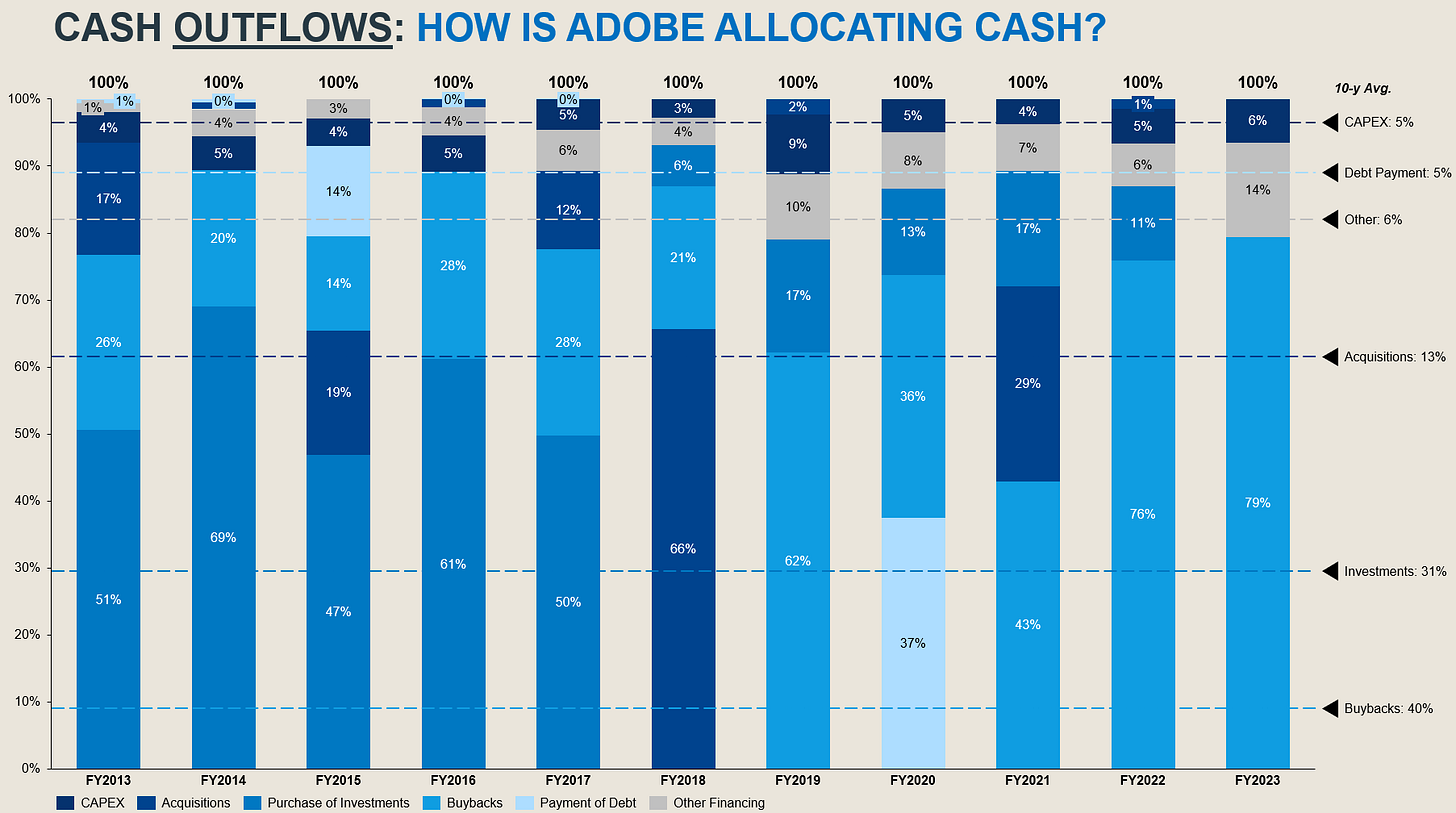

Capital allocation refers to the process through which a company decides how to use its financial resources to maximize shareholder value. Adobe's capital allocation strategy has been a key driver of its transformation and success. By prioritizing innovation, strategic acquisitions, and shareholder returns, Narayen has effectively utilized capital allocation to position Adobe as a leader in the technology sector. Below show how capital has been allocated historically:

Historic Cash Outflows

Worth noting is the increased buybacks starting in 2019 and further intensified in 2022-2023. One could argue that Narayen has been following the guidance from Warren Buffett on the timing of the repurchases: "Repurchases - is sensible [allocation of capital] for a company when its shares sell at a meaningful discount to conservatively calculated intrinsic value. But never forget: In repurchase decisions: price is all important. Value is destroyed when purchases are made above intrinsic value.” Below snip of buyback rate suggest that Adobe indeed has doubled-down on repurchasing shares while they were trading at a discount during 2022.

Also worth noting is the always low CAPEX spending compared to other investments. Adobe is indeed an asset-light business.

Historic Cash Inflows

Adobe has mainly funded their outflows through operating cash flows and sale of investments (marketable securities). Highly important, as a red flag would be if Adobe mainly funded the outflows with e.g., newly issued debt and stocks (Adobe has been a net repurchaser of stocks and net payer of debt past 10 years). Also, when Adobe has engaged in M&As, these have mainly been funded through debt.

Historic Buyback Rate

Scoping in on Adobe’s buyback rate past 10 years suggest that this capital allocation strategy has been increasingly important for Narayen. Net repurchases as % of FCF past three financials years all above 10-y average. The peak in 2022 may suggest that Adobe has been following Buffett’s guidance, as it looks like they have intensified the buybacks as the Adobe stock declined 60% during 2022.

Historic Value Creation: CFROI vs. Cost of Capital

Another measure to assess Adobe’s capital allocation performance and whether they have created value for shareholders is by looking at the CFROI against Cost of Capital. CFROI is measured by OCF / Capital Employed. Here, it is evident that Adobe has been creating much value for shareholders past 10 years.

Conclusion: Adobe's capital allocation strategy has been a key driver of its transformation and success. By prioritizing innovation, strategic acquisitions, and shareholder returns, Narayen has effectively utilized capital allocation to position Adobe as a leader in the technology sector. Adobe is a capital-light business and the capital allocated for future growth has, historically, had a great return on investment. Hopefully Narayen and the team can continue its capital allocation strategy going forward!

8. Adobe valuation

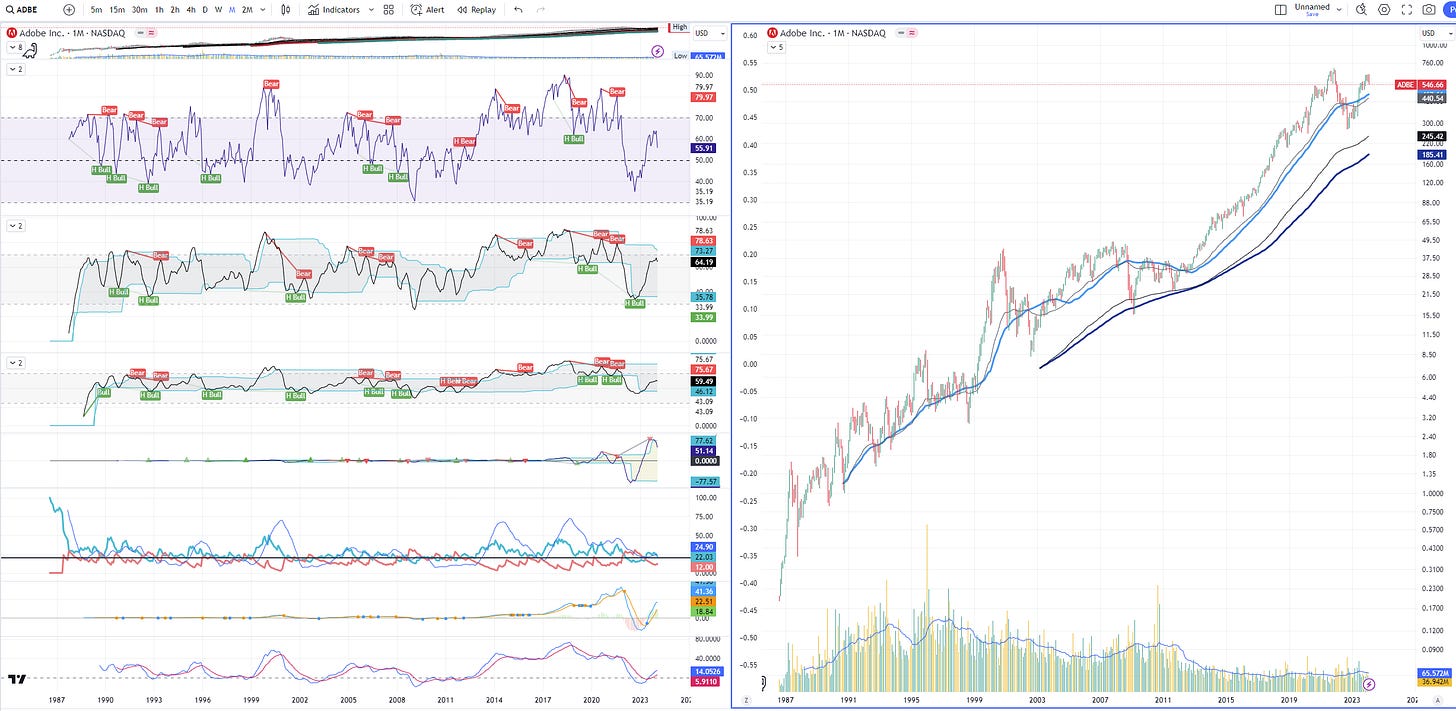

I've always emphasized a focus on business fundamentals over charts when investing. However, combining chart insights with fundamental analysis helps pinpoint where potential buyers and sellers have historically been located. This merged approach aids in understanding market momentum and future trends. It's not about market timing, but acquiring strong companies at sensible prices.

*Numbers from 15-02-2024!

Current trading multiples/ratios compared to peers

Current multiples of Adobe (price of stock: $590.45) can be seen below. Comparing those multiples to Adobe’s direct and indirect competitors, we get the following trading multiples/ratios:

Adobe seems overvalued to some degree when comparing multiples with peers. It must however be noted that selected peers are not perfectly comparable to Adobe, but serve largely as proxy.

Historic trading multiples

Adobe is trading around historic averages on sales, earnings, and FCF. From a technical-fundamental point of view, Adobe may increase in value going forward and reach pandemic high multiples, if US tech stocks continue its current greed!

DCF valuation and FCF Yield short-term scenarios

To triangulate the findings, two DCF valuations have been created to assess Adobe’s attractiveness at current price levels.

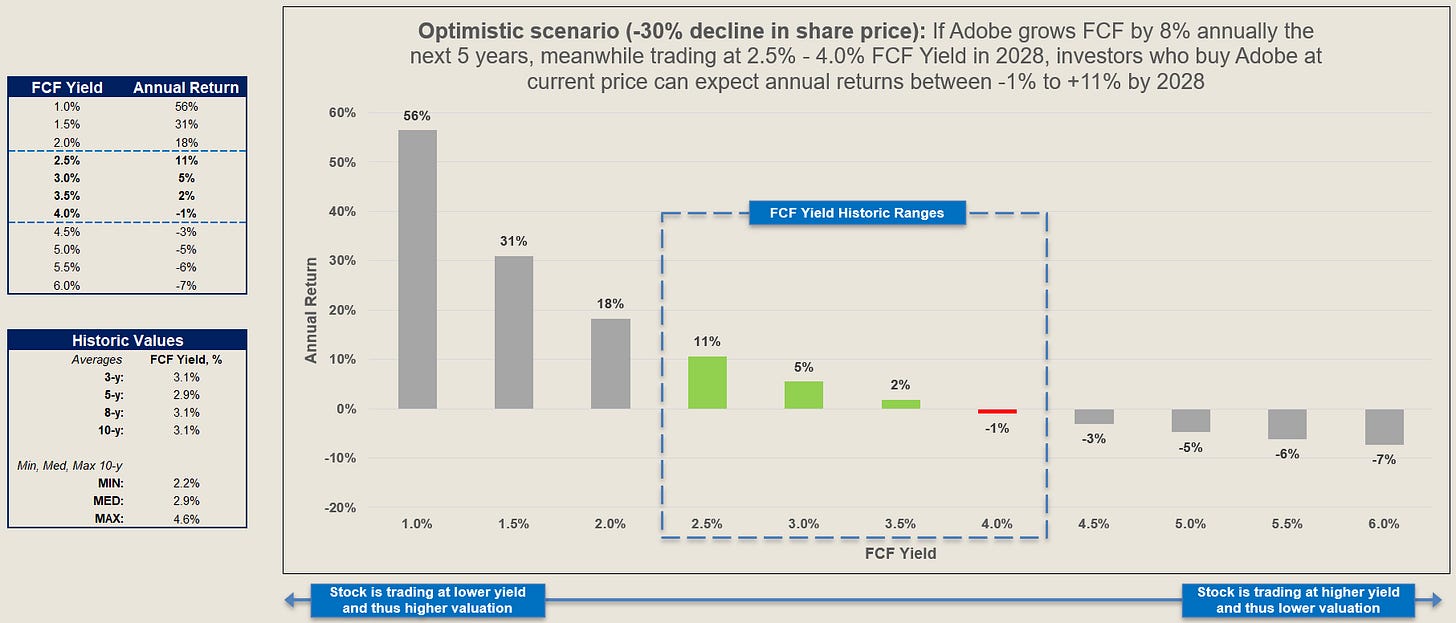

Scenario 1: Optimistic case

From an optimistic perspective, Adobe seems overvalued to some degree. This scenario has built in that Adobe will reverse its slowing growth trends past three years, and start growing faster in the short-term. Adobe will also withstand new entrants to the industry and will not be impacted by e.g., OpenAI and Gemini AI generative solutions. Margins are stable and higher than historic performance. Given this, Adobe should be trading at around $505 a share, and investors could expect low annual returns (-7% - +1%) if buying a today’s prices and sells in 5 years. No margin of safety from this perspective.

If we use same projected operational performance, and Adobe would decline 30% from today’s prices because of noise in the market (e.g., OpenAI), investors can expect annual returns of -1% - +11% if selling in 5 years AND Adobe continues to be selling at a premium (FCF Yield of e.g., 2.5%).

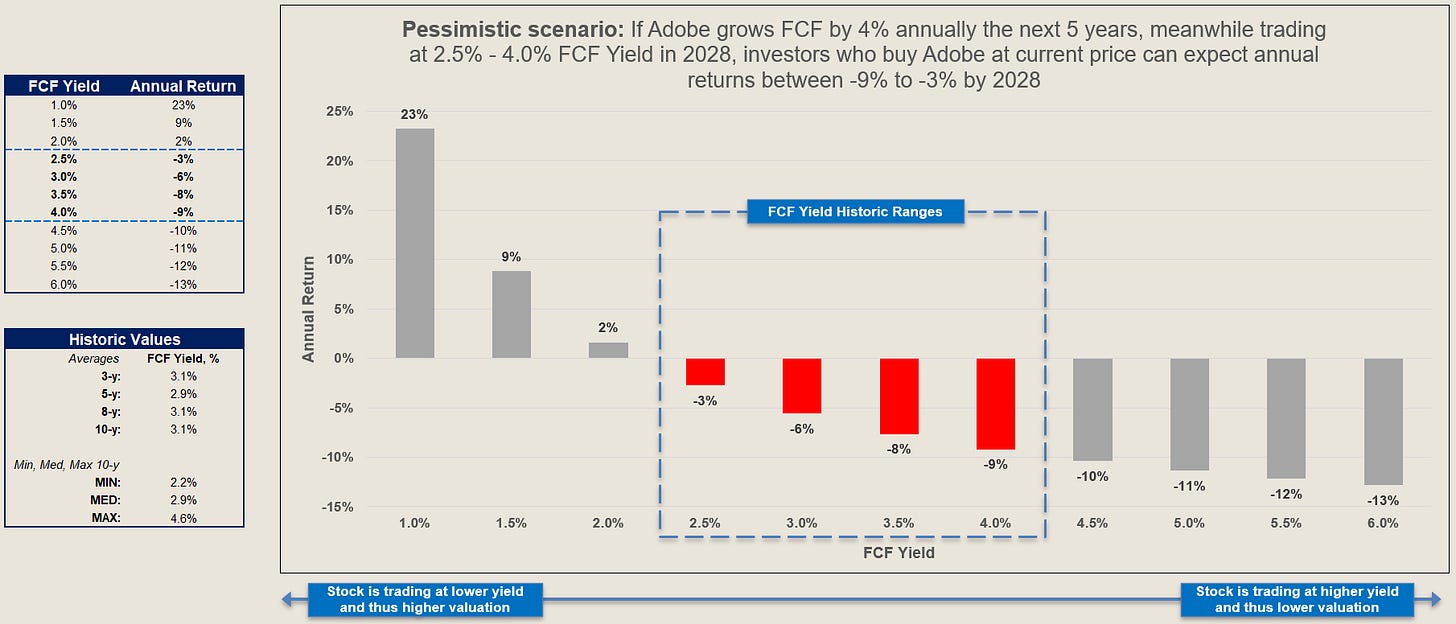

Scenario 2: Pessimistic case

From a pessimistic perspective, Adobe seems (again) overvalued, but this time by a wider margin. This scenario is building on the story that Adobe cannot pick up topline growth and the projected margins for 2024 (analyst estimates) decrease to historic averages (35%). Adobe cannot withstand increased competition and MOAT fades slowly over time. If investors believe in this story, they should only pay $288 per share. FCF Yield exemplifies the overvaluation and investors cannot expect positive annual returns, only if Adobe would be trading at a FCF Yield of 2.0% or below.

A imaginary 30% decline of Adobe stocks would help investors in this pessimistic scenario, but again, low annual returns could be expected by 2028.

All in all, from all valuations, Adobe seems to be trading at a premium and thus somewhat overvalued. Current trading prices does not offer any margin of safety to compensate investors for the future uncertainties (can Adobe pick up topline growth? How will they be impacted by competitors in the future? …)

9. Technical analysis of Adobe

Adobe declined around 60% during 2022, but has since reversed and increased more than 130% from 2022-low. From the weekly charts, it is also evident that this increase seems to be a bit overstretched and that a sell-off would be healthy. Recent sell-offs (due to market noise: OpenAI’s threat to Firefly) may find a base around $480-$535.

10. Adobe’s short- and long-term challenges

Adobe, amidst its robust financial standing and industry dominance, grapples with a spectrum of challenges. The company operates in fiercely competitive markets, contending against heavyweights like Microsoft and Apple, as well as a plethora of smaller entities offering specialized or more affordable alternatives. This necessitates relentless innovation and vigorous marketing efforts to sustain its market lead. The rapid pace of technological evolution in the tech sector mandates that Adobe persistently innovates and upgrades its offerings to align with shifting consumer demands and stay abreast of emergent technologies, including AI and machine learning.

While the transition to a subscription model has notably propelled Adobe's success, the possibility of market saturation looms. To fuel ongoing growth, Adobe might need to venture into new markets or augment the value proposition of its existing subscriptions. Despite the model's efficacy in curtailing piracy, safeguarding intellectual property remains a formidable challenge, particularly in global markets with less stringent IP regulations.

Ensuring customer retention is paramount in the subscription landscape. Adobe is tasked with the continuous evolution of its products and services to meet consumer expectations and preclude customer attrition. As a custodian of vast quantities of customer data and intellectual property, Adobe is invariably a prime target for cyber threats, making data security a critical priority to preserve trust and adhere to global data protection norms.

Other short-term challenges include risks of Shantanu Narayen leaving. Narayen's visionary leadership was instrumental in Adobe's pivotal shift to a SaaS model, and his influence is deeply intertwined with the company's current success. His potential departure could notably alter the investment thesis and the company's future trajectory. In the event that he departs the company for any reason, we'll be attentively monitoring the transition in leadership. Fortunately, at 60 years old, Narayen is not super old, suggesting that he likely has more productive years ahead to continue steering Adobe forward.

Other short-term challenges include the risk of a potential revenue slowdown. Adobe experienced an accelerated demand during the pandemic as global digital engagement surged. However, as this momentum normalizes, the company is witnessing a slight deceleration in growth. Although the growth catalysts expected to drive Adobe forward are not yet making a substantial impact, there's an anticipation of a phase of moderated growth. Despite this, the underlying belief in the long-term durability and robustness of Adobe's business growth remains steadfast.

Navigating these challenges is imperative for Adobe to preserve its market leadership and financial health, demanding a blend of continuous innovation, strategic foresight, and flexible market approaches.

11. Adobe’s opportunities going forward

Adobe is poised for substantial growth and continued industry leadership, thanks to a plethora of long-term opportunities:

AI: At the forefront of innovation, Adobe's foray into AI and machine learning is set to redefine its product offerings. By automating routine tasks and providing advanced, personalized user experiences, Adobe is not just enhancing its digital marketing solutions but is also setting a new standard in the industry. Moreover, holding Adobe shares for the long haul could serve as a strategic safeguard in the era of AI, given that artistic creativity, a profoundly human trait, is less likely to be eclipsed by automation or AI compared to other professions. While prevailing perceptions often depict a dystopian 'us versus them' scenario between humans and machines, a more optimistic perspective suggests a symbiotic integration, where AI augments human capabilities, much like smartphones do today. Adobe, at the vanguard of this integration, harnesses AI and machine learning not just to refine its software but to amplify the capabilities of content creators, ensuring their roles evolve rather than become redundant. This strategic integration of AI is reshaping Adobe's product landscape, where routine task automation and the delivery of advanced, personalized user experiences are not merely enhancing its digital marketing solutions, but are also establishing new industry benchmarks.

AR/VR: Other opportunities include the demand for immersive content in 3D, augmented reality (AR), and virtual reality (VR) is on the rise. Adobe's established platforms are in a prime position to cater to this need, offering comprehensive solutions that seamlessly integrate these technologies.

Cloud Computing: the shift toward cloud computing opens new avenues for Adobe to enhance its cloud services. The company has the opportunity to refine its cloud-based tools further and provide secure, scalable solutions tailored for the modern workforce's needs, particularly in remote work and collaboration.

Emerging markets: In emerging markets, the company is well-positioned to capitalize on the increasing digital literacy and internet penetration, a shift that promises a surge in demand for Adobe's suite of creative and marketing software solutions.

Inorganic growth and partnerships: Adobe has amassed significant cash reserves, providing it with substantial resources to fuel inorganic growth and invest in the latest technologies, crucial elements for its future expansion. Additionally, the potential for strategic partnerships and collaborations opens up a broad spectrum of opportunities. By forming alliances with other major players in the industry, Adobe is well-positioned not just to penetrate new markets but also to enhance its product portfolio, thereby maintaining its status as a pioneer in technology and innovation.

In navigating these opportunities with strategic precision and a commitment to innovation, Adobe is set to fortify its position as a leader in the digital landscape, ensuring sustained growth and relevance in a rapidly evolving industry.

12. Final remarks

Adobe's trajectory has been nothing short of remarkable, boasting a stellar financial track record over the past decade. Despite the deceleration in growth rates, Adobe remains a formidable force. The company faces challenges but continues to hold a significant edge in the market. With substantial market shares in key verticals and a long history of driving global creativity and connectivity through innovation, Adobe's resilience is evident. Historical challenges from industry shifts or competition haven't deterred Adobe; under Narayen's leadership, the company's strategic capital allocation—through hefty R&D investments and tactical acquisitions—has consistently bolstered its competitive position, a trend unlikely to waver.

HOWEVER, Adobe's current valuation suggests a premium price, hinting at potential overvaluation. The current market price offers little safety margin against future uncertainties, including slower growth, technological shifts, and competitive pressures. No one can foresee the future.

Should Adobe's stock price fall more than 30% from its current level, my interest in it as an investment would notably increase.