In the ever-evolving landscape of the technology sector, Alphabet (GOOG/GOOGL) stands out as a titan whose strategic initiatives and robust financial performance continually draw investor interest. Recently, the company has faced its share of market volatility and criticism, notably concerning its perceived sluggishness in the AI race—a critique that contrasts sharply with its historical image as an innovation leader. Despite these challenges, Alphabet has made significant strides, such as its foray into in-house chip production and advancements in AI, actions that not only counteract negative press but also solidify its competitive position. This investment case will explore how Alphabet's innovative strategies and resilience amid market and media noise make it a compelling choice for investors looking to capitalize on the dynamic growth of the tech industry on the long-term.

Alphabet trades under GOOGL and GOOG. As of April 2024, Alphabet has a market cap of $1.989 trillion. This makes Alphabet the world's 5th most valuable company by market cap, in between Saudi Aramco and Amazon.

*Google and Alphabet will be used interchangeably during this post.

This deep-dive has the following chapters:

Introduction

Segments

Business models

Growth strategy

Competitors

Management review

Ownership

Moats

Financial performance

Capital allocation and Value Creation

Valuation

Short- and long-term challenges

Opportunities going forward: Why Google’s Recent missteps will not derail its long-term potential

Final remarks

1. Introduction

Google, a subsidiary of Alphabet Inc., stands as a colossus in the digital age, pioneering the realms of internet search, online advertising, and a plethora of technological innovations that span from cloud computing to AI. With its search engine commanding a vast majority of the global market share, Google has evolved into a multifaceted behemoth, offering an extensive array of services and products that include YouTube, Android, and Google Cloud, among others. Its relentless pursuit of innovation has also propelled it into the forefront of AI research and development, further cementing its position as a leader in the tech industry. For investors, Google represents a unique blend of stability and cutting-edge technology, a company that continually redefines the boundaries of what's possible in the digital world, all while maintaining robust financial performance and growth potential.

The founders Larry and Sergey wrote in the original founders' letter, "Google is not a conventional company. We do not intend to become one." That unconventional spirit has been a driving force throughout our history, inspiring Google to tackle big problems and invest in moonshots. It led us to be a pioneer in the development of AI and, since 2016, an AI-first company. Google continue this work under the leadership of Alphabet and Google CEO, Sundar Pichai.

Shares of Google (GOOGL) has since its IPO in 2004 risen 6,123%. That’s 62x if you invested at the IPO two decades ago.

2. Segments

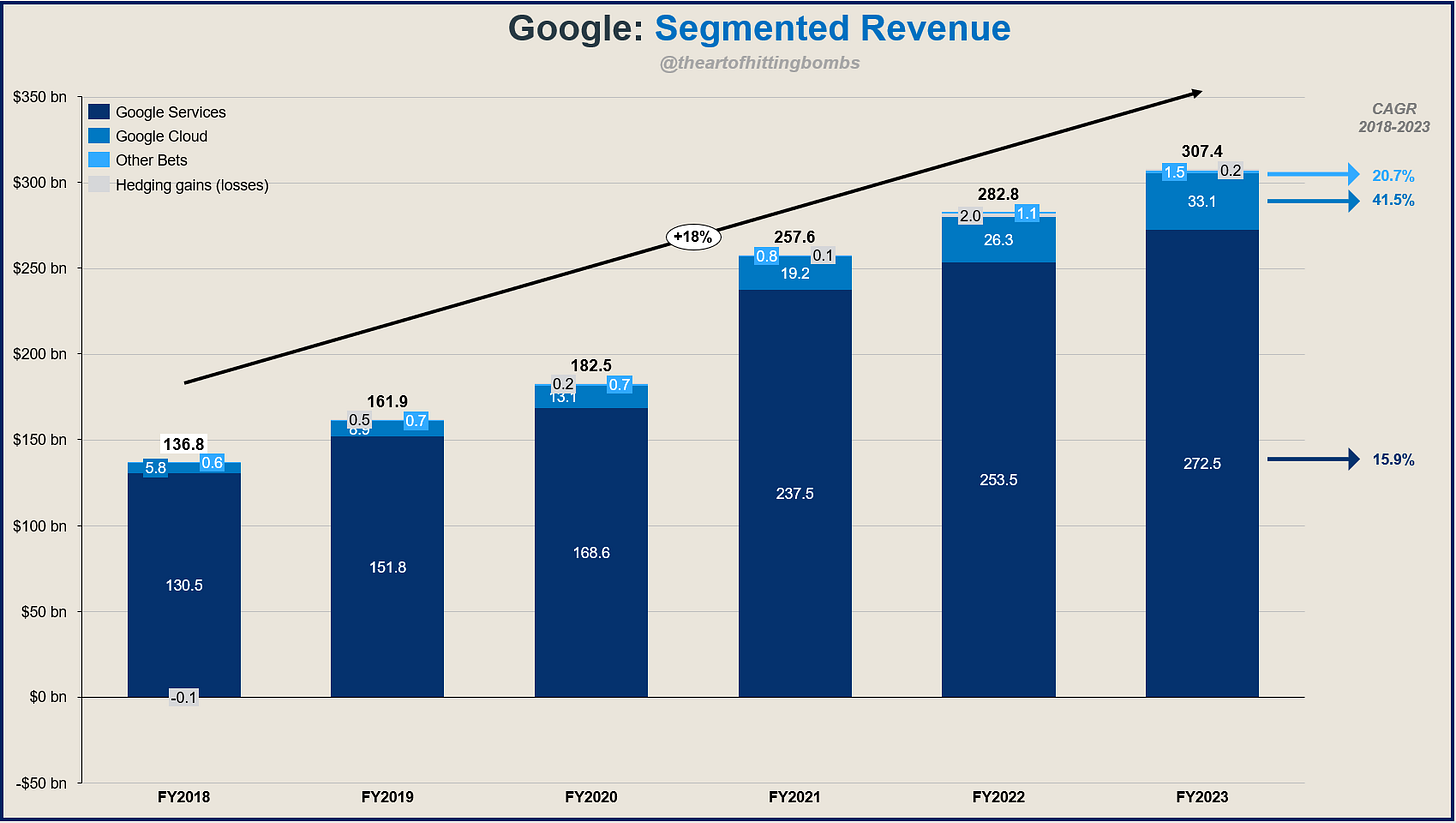

Alphabet is a collection of businesses — the largest of which is Google. They report Google in two segments, Google Services and Google Cloud, and all non-Google businesses collectively as Other Bets. Alphabet's structure is about helping each of our businesses prosper through strong leaders and independence.

These segments—Google Services, Google Cloud, and Other Bets, serve as a testament to Google's strategic diversification and its pursuit of growth across various fronts:

Google Services encompasses the vast array of consumer-facing products such as Search, YouTube, Android, and Google Assistant, which continue to be the powerhouse behind Google's advertising revenue. Google Search helps people find information and make sense of the world in more natural and intuitive ways, with trillions of searches on Google every year. YouTube provides people with entertainment, information, and opportunities to learn something new. Google Assistant offers the best way to get things done seamlessly across different devices, providing intelligent help throughout a person's day, no matter where they are.

The Google Cloud segment, on the other hand, represents Google's ambitious foray into the cloud computing market, offering infrastructure and platform services, data analytics, and machine learning, catering to both enterprises and developers.

The Other Bets segment is where Google's forward-looking vision comes to life, encapsulating long-term projects and companies with the potential to disrupt industries, such as Waymo's self-driving technology and Verily's health-tech innovations.

Furthermore, Google has a truly global footprint, deriving revenue from across the world, underscoring its vast geographic exposure. The United States remains its largest market, contributing a significant portion of its overall revenue, indicative of the robust digital advertising ecosystem in the country and Google's deep penetration into American digital life. However, Google's international revenues are not to be underestimated, with substantial contributions coming from Europe, the Asia-Pacific region, and other emerging markets. The diversity in Google's geographic revenue streams is reflective of the universal applicability and demand for its search, advertising, cloud computing, and hardware products. This global reach not only diversifies Google's revenue sources but also mitigates risks associated with market-specific challenges. Despite varying degrees of market maturity and regulatory environments across regions, Google's continuous growth and adaptation strategies have ensured its prominence and revenue generation on a global scale.

KEY TAKE-AWAYS

Together, these segments, both geographically and from a product- and service portfolio perspective, illustrate Google's commitment to innovation, diversification, and long-term value creation, making it a compelling entity in the investment realm. 3. Business models

Each segment of Google's business, from its foundational Services to the innovative Cloud platform, and the visionary Other Bets, showcases a strategic blend of immediate utility and futuristic ambition. These segments collectively underpin Google's vast ecosystem, driving revenue, fostering innovation, and setting the stage for the next leaps in technology and digital services. Below, we delve into the essence and operational dynamics of Google Services, Google Cloud, and Other Bets, unraveling how each contributes uniquely to Google's global leadership and continuous evolution in the digital era:

Google Services: Google Services is essentially the engine of advertisement revenue, leveraging the vast data harvested from its ecosystem to offer targeted advertising solutions. This model not only capitalizes on user data to optimize ad placements but also enriches the user experience by integrating services seamlessly across devices and platforms. It's a virtuous cycle of engagement and monetization, ensuring Google remains at the forefront of the digital age. AI has been a cornerstone of Google's advertising strategy for over a decade. With products such as Performance Max and Product Studio, Google leverages the full potential of its AI to uncover new and incremental conversion opportunities for advertisers.

Google Cloud: Venturing into the cloud, Google has meticulously crafted its Cloud segment to be a cornerstone of modern enterprise infrastructure. Google Cloud offers a suite of cloud services, including computing, storage, networking, and machine learning, aimed at businesses seeking to digitize their operations. This segment operates on a consumption-based model, where businesses pay for the services they use, allowing for scalable and flexible solutions. Google Cloud not only diversifies Google's revenue streams beyond advertising but also positions the company as a pivotal player in the digital transformation of industries worldwide.

Other Bets: The most speculative yet potentially transformative aspect of Google's empire lies within its Other Bets segment. This segment is a breeding ground for innovation, encompassing a diverse portfolio of startups and projects such as Waymo's autonomous vehicles and Verily's health technologies. Unlike the more established segments, Other Bets operates on a long-term investment model, where Google seeds futuristic projects with the potential to disrupt entire industries. Although financially riskier and often not immediately profitable, this segment underscores Google's commitment to pioneering advancements that could redefine technology and society.

KEY TAKE-AWAYS

Google's business structure spans three main segments: Google Services, Google Cloud, and Other Bets, each serving distinct strategic purposes. Google Services harnesses extensive user data and advanced AI to drive advertising revenue and enhance user experiences. Google Cloud offers scalable enterprise solutions, broadening Google's revenue beyond advertising and supporting global digital transformation. Other Bets, while more speculative, funds high-impact projects like autonomous vehicles and health technologies, showcasing Google's commitment to pioneering future industries.4. Growth Strategy

Google has not organically grown into offering these products and services; Google has since its origin been an active acquirer of new businesses, integrating them into new or existing products. Google's growth strategy has historically been marked by innovation, diversification, and strategic acquisitions, propelling it from a search engine to a multifaceted tech giant. Central to its expansion has been a relentless pursuit of enhancing and broadening its service offerings, from refining search algorithms to entering new markets like cloud computing, mobile operating systems, and autonomous vehicles. Google has adeptly used acquisitions as a lever to enter new markets, access cutting-edge technologies, and consolidate its market position.

Key acquisitions have been instrumental in shaping Google's ecosystem and fortifying its competitive edge. The acquisition of Android in 2005 was a game-changer, positioning Google at the heart of mobile technology and enabling it to capture a significant share of the global smartphone market. YouTube, acquired in 2006, became a cornerstone of Google's video streaming strategy, transforming it into the world's leading video content platform. More recently, Google's acquisition of Looker in 2019, Fitbit in 2021, Mandiant in 2022, underscored its ambitions in data analytics, wearables (competitor to Apple Watch), cloud security, respectively, highlighting its continuous search for growth opportunities across the tech spectrum.

KEY TAKE-AWAYS

These strategic moves are underpinned by Google's ability to seamlessly integrate new technologies and platforms into its ecosystem, creating synergies that drive user engagement, data collection, and ultimately, revenue growth. Through this combination of organic growth initiatives and judicious acquisitions, Google has not only diversified its product portfolio but also entrenched its position as a leader in innovation, setting the stage for sustained growth in the digital age. And Google still has vast dry-powder to be used if threats to their competitive position should rise; Google is currently sitting at $110.9 billion of cash. 5. Competitors

In the competitive landscape of the tech industry, Google stands as a formidable entity, yet it faces significant challenges across its two primary segments: Google Services and Google Cloud. Each segment encounters unique competitors that test Google's innovation, strategy, and market adaptability. Here, we delve into the key rivals within these segments, highlighting the dynamic competition that influences Google's strategic decisions and shapes its approach to maintaining and expanding its market dominance.

In the Google Services segment, Google faces stiff competition across its product lines. For Search, Microsoft's Bing and emerging AI-driven search technologies offer alternatives. In the video streaming domain, YouTube vies with platforms like Vimeo, TikTok, and traditional media companies' streaming services. Google's advertising arm competes with Meta Platforms’ extensive social media advertising network and Amazon's growing advertising platform, leveraging its e-commerce dominance.

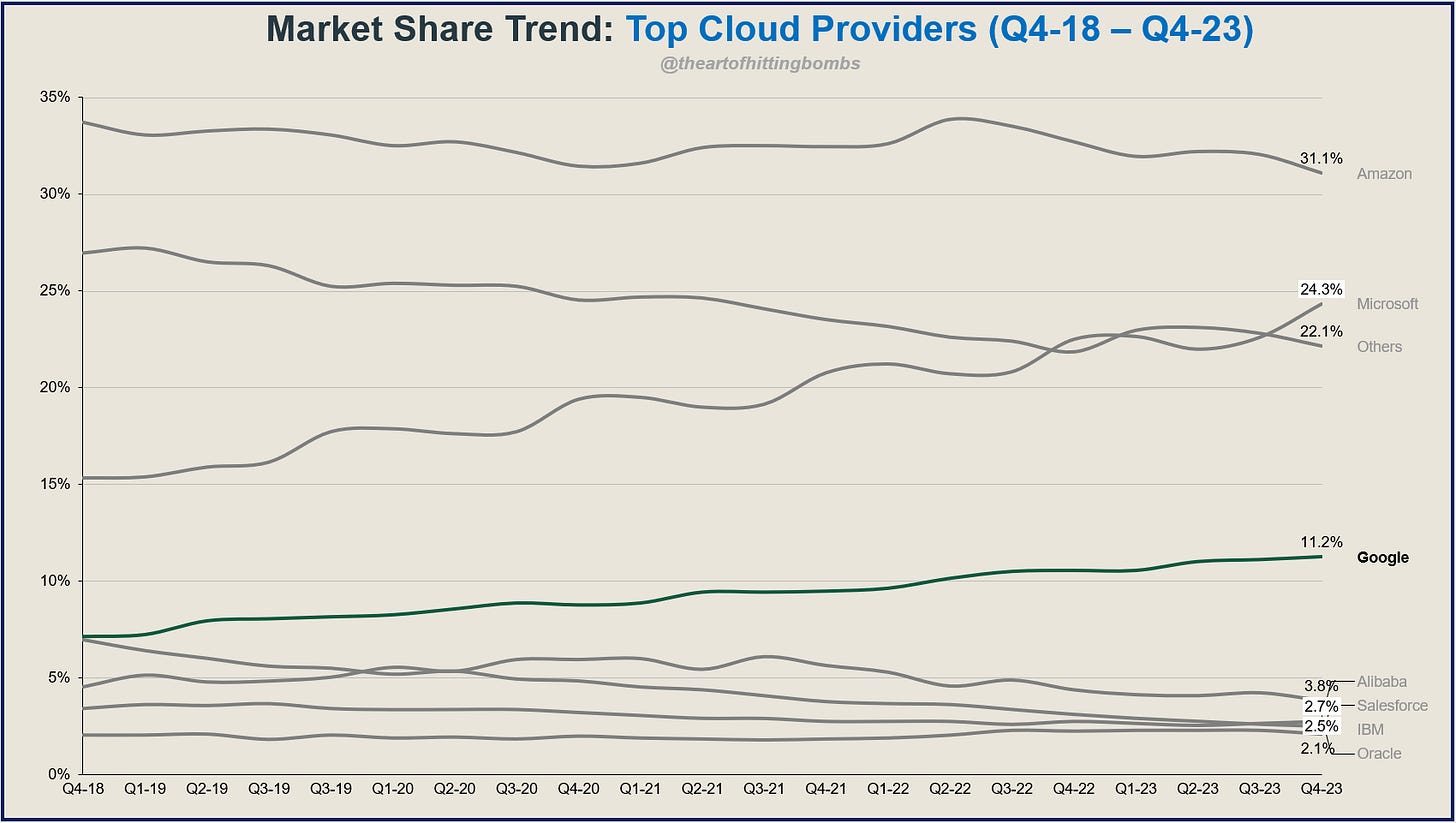

In Cloud services, Google Cloud contends with industry giants like Amazon Web Services and Microsoft Azure, both of which lead the market in cloud computing, offering a broad range of services from infrastructure to platform solutions, and are favored for their extensive global infrastructure, wide range of tools, and deep enterprise integration.

Google's strategy against these competitors involves continuous innovation, leveraging AI and machine learning, and expanding its services ecosystem to maintain and grow its market share. Below, we’ll get some numbers on the table to assess the competitive landscape and threats to Google.

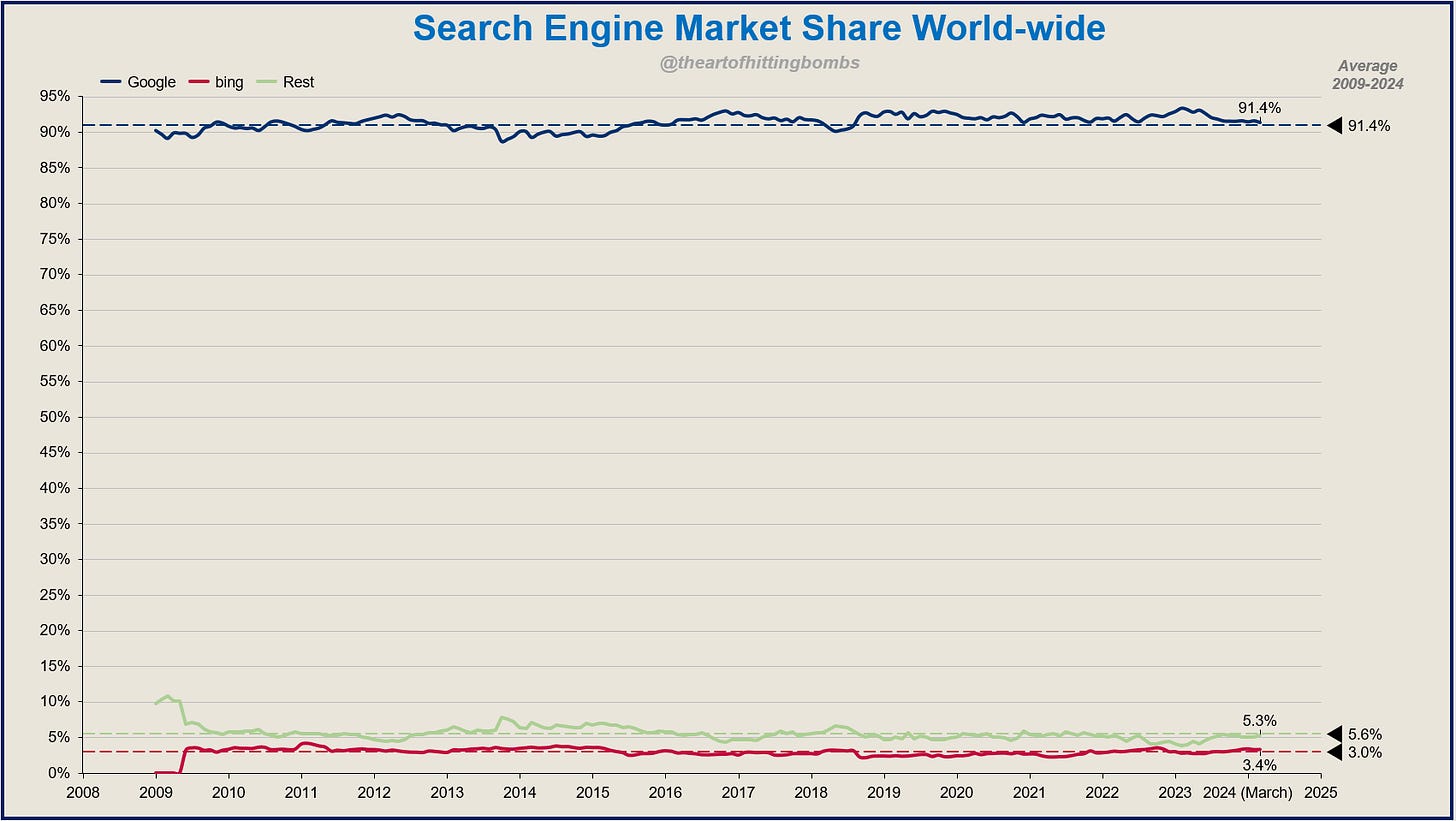

Google Search vs. Bing, and the rest

As of March 2024, Google continues to dominate the global search engine landscape, commanding a formidable 91.4% of the market (considering all devices e.g., desktop, mobile, and tablet), according to the latest research from statcounter. This overwhelming majority underscores Google's unrivaled position as the premier gateway to the internet for users around the world. The company's ability to maintain such a dominant market presence highlights its continuous innovation, user-focused design, and the extensive reach of its services.

Since 2009, the least market share Google has had world-wide was 88.7% and has averaged 91.4%. Crazy dominance. Google market share has been in the range 88.7% to 93.4%, and bing has been in the range 0.0% to 4.2%. Google’s market share peaked in February 2023, i.e. after launch of ChatGPT(!), and had its lowest share in October 2013. Bing peaked in February 2011.

Since 2009, the least market share Google has had in North America was 79.3% (arguably the toughest market), and has averaged 86.3%. Still, crazy dominance. Google market share has been in the range 86.3% to 90.3%, and bing has been in the range 0.0% to 9.2%. Again, Google’s market share peaked after launch of ChatGPT (!!!) in May 2023, and had its lowest share in March 2009. Bing peaked in June 2013.

What does this imply?

Since launch of ChatGPT in November 30th 2022, there has, from this perspective, no impact to Google’s Search dominance at all. This supports the argument that GPTs and general ‘Search’ are used for different purposes and use-cases. One may argue that dominance has become stronger, as users wants facts and not chatbot generated information. An example is that you do not use ChatGPT when searching for restaurant reviews. YouTube vs. TikTok, Instagram, and Twitch

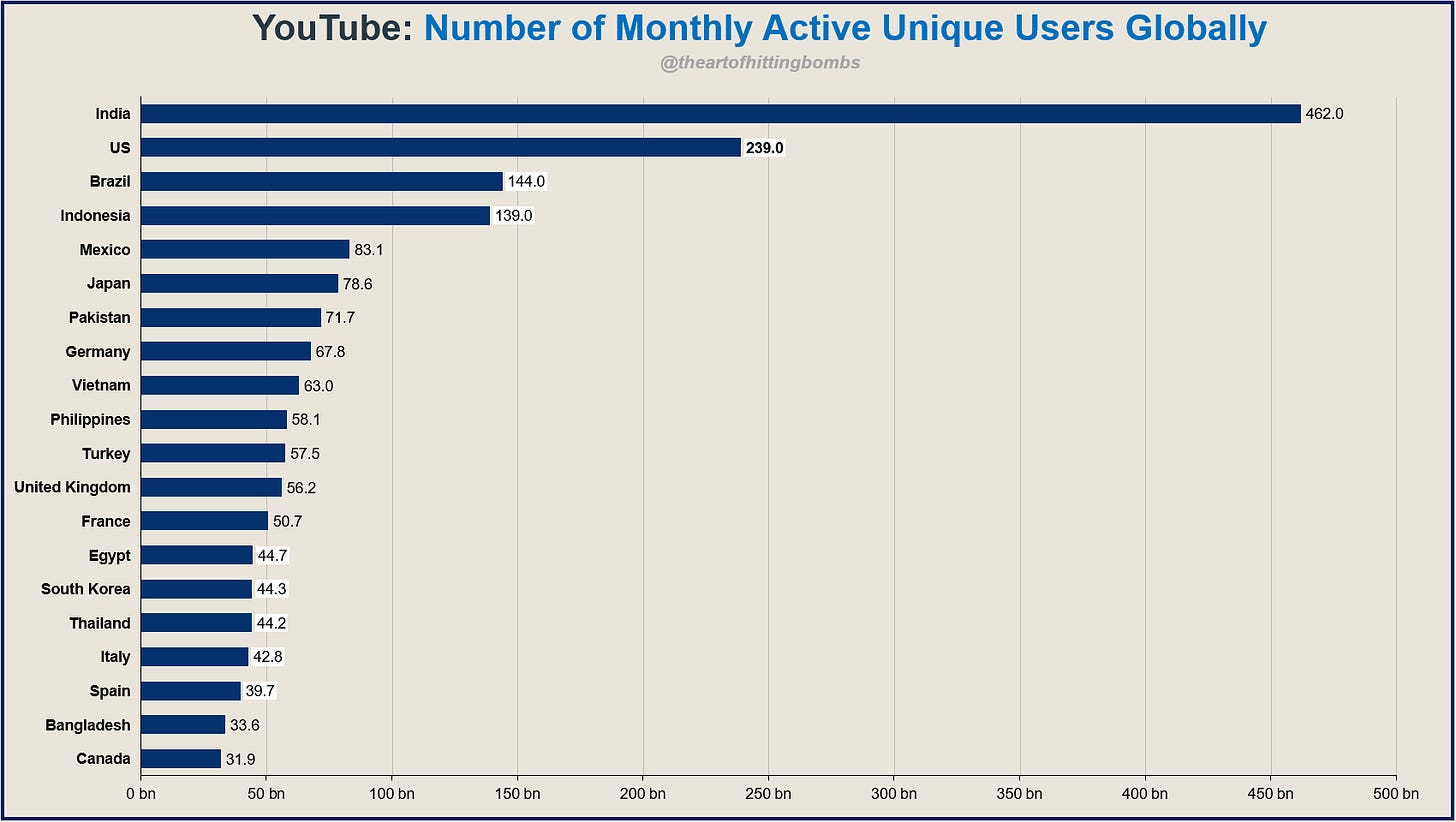

While you may not consider YouTube to be a typical social media platform, it’s still a place for people to connect with one another through videos and in the comments section. When looking at it in terms of active users, YouTube ranks as as the second most popular platform in the world. It ranks just behind Facebook, which currently has control of the number one spot. Instagram ranks 4th and TikTok ranks the 5th. And Twitch not even in top 15. YouTube competes on multiple fronts, including the time spent by users on the platform, the number of active users, content diversity and quality, and the effectiveness of its advertising model. It also focuses on user engagement metrics such as video views, likes, and comments, which help in understanding the content's popularity and viewer preferences. Additionally, YouTube's competition extends to attracting and retaining content creators, as they are integral to the platform's content ecosystem and user attraction. Below are snips of user growth compared to peers.

Meta Platforms with strong multi-app presence in top 5. Impressive. YouTube being the second most popular platform in the world.

YouTube has experienced a steep increase since 2010, growing with a CAGR of 20%. That said, YouTube monthly user growth rates have been slowing down since 2020, which may be concerning. Interesting to see how they will work attracting new users, user engagement, and monetization.

Most popular geography is India, by far, following US, Brazil, and Indonesia. Following is a quick and rough estimation of YouTube’s market share of total addressable market:

World population: 8.1 billion

Banned YouTube countries: North Korea (population: 26.07M), Libya (population: 6.812M), Turkmenistan (population: 6.431M), China (population: 1,412M), Iran (population: 88.55M), and Russia (population: 144.2M). Total banned addressable market: 1.7 billion people.

Access to internet: 66%

World population (less banned countries) with access to internet: 4.2 billion.

Assuming target group (excluding infants and elderly people) to be 80% of 4.2 billion, then we arrive at 3.4 billion as total addressable market for YouTube, i.e., 0.7 billion users can potentially be added in the future. Moreover, more people will likely grow into the target group (younger generation with internet experience more likely to be a user of YouTube than elderly people), as well as general world population growth. NB! This is high-level estimates.

Google Ads vs. Meta Platforms, Amazon, and the rest

How is Google performing on Ads relative to peers? To assess this, we have taken point of departure in the US ad market which by far is the largest in the world on digital ad spending. This is a proxy for its dominance.

Within the US market, Google accounted for 28.6% of the total digital advertising revenue in 2022 (actuals) in the US, and was the largest digital ad publisher in the country. Meta and Amazon followed, with 23.8% and 11.3%, respectively. Google’s market share is expected to decline from 28.4% to 24.6% in 2025, according to Statista; an indication that market is getting more mature and competitive (Amazon doubling down on the ad industry).

Google is still by far the biggest digital advertiser in the US, yet with a declining market share. Interesting to see how Google is going to respond in the future to the added competition. One thing which may calm long-term Alphabet investors is their integration of AI into their ad universe. Philipp Schindler (SVP and Chief Business Officer of Google) said the following in regards to ads in the future and the impact of AI during Morgan Stanley Technology, Media, and Telecom Conference on March 6th, 2024:

“We have used AI in our core ads systems I think for probably roughly a decade now. Also, an interesting metric, roughly, or a little bit over 80% of all of our advertisers are using at least one AI-powered Search solution, which tells you there's a lot of acceptance for those type of solutions. But it also tells you there's still a lot of opportunity left here. So a lot of really, really interesting applications in the current ads environment already of the AI technology. Again, we've been using this for a long time.”

What does this imply?

Google remains the leader in the US (and global) digital advertising market but faces declining market share, indicating increased competition, particularly from Amazon. Despite this challenge, Google's strategic integration of AI into its advertising ecosystem is a key factor that may reassure investors about its capacity to maintain competitiveness. With over 80% of Google's advertisers utilizing at least one AI-powered search solution, there's evident acceptance and still ample room for growth in applying AI technologies. Google's long-standing use of AI in ads underscores its commitment to innovation and adapting to market dynamics, positioning it well for future developments in the advertising sector.Google Cloud vs. Amazon Web Services, Microsoft Azure, and the rest

World-wide market share of leading cloud infrastructure service providers per Q4-23. Amazon and Microsoft are clear leaders, but closely followed by Google. Microsoft with impressive growth trend, Google with similar trend, however not so impressive. Amazon with declining shares since Q2-22. Total market, according to Statista were $73.7 billions by Q4-23.

Interesting to see if Google can keep or even increase the pace of capturing market shares. The Cloud infrastructure market itself is increasing, so keeping the market shares as-is will be lucrative for Google.

Philipp Schindler (SVP and Chief Business Officer of Google) said the following in regards to Google Cloud at the Morgan Stanley Technology, Media, and Telecom Conference on March 6th, 2024:

“… and on the Cloud side, I think we have found a very good path of how we can monetize this and how we can look at this. We have basically three big areas that's probably worthwhile calling out.

On one side, you have the whole infrastructure side where we supply highly AI optimized infrastructure, based on GPUs and our beloved TPUs, obviously number one.

We have the whole platform layer, we call it Vertex AI, where we offer first party models and third-party models and open-source models, and where we offer solution and development tools so everybody can develop their own AI applications, so a really exciting area as well.

And then we have the application part of our Cloud business, which is basically – probably best described as split into two.

On one hand, you have the Gemini and Workspace opportunity here. And just think about what we can do with Gmail and Docs and Calendar integration in a very smart and sophisticated way. So, that's a good area to watch.

And then a second one is obviously the Gemini and GCP integration where we're providing smart assistance to basically whoever you are. If you're a data analyst, if you're a developer, if you're a security professional, you will get the best smart assistants that you can imagine, based on our AI technology via our Google Cloud business.

… So, I think that's a pretty holistic description of where we see the opportunities here, and yeah, I'm excited about it.”

Another interesting analysis the Gartner Magic Quadrant for Strategic Cloud Platform Services from 2023. This ‘Magic Quadrant’ serves as a comprehensive guide for organizations considering cloud providers for their digital transformation journeys. It evaluates providers based on their ability to execute and completeness of vision, categorizing them into four segments: Leaders, Challengers, Visionaries, and Niche Players. This year, Amazon Web Services (AWS), Microsoft, Google, and Oracle were recognized as leaders for their broad range of services, ambitious roadmaps, and strong market presence. AWS, for instance, is highlighted for its mature cloud infrastructure and platform services, which set industry standards for capabilities and pricing. Microsoft Azure is praised for its strong performance across all use cases and its capability to facilitate hybrid- and multi-cloud transformations. Google Cloud Platform is acknowledged for infusing its services with AI and excelling in nearly all IaaS and PaaS use cases, while Oracle is noted for its strength in distributed and sovereign cloud computing, offering various deployment options suitable for strict data privacy regulations.

What does this imply?

As the cloud infrastructure market continues to expand, with a total market size reaching $73.7 billion by Q4-2023, Google Cloud's position is notably strong yet trails behind the clear leaders, Amazon and Microsoft. While Microsoft demonstrates an impressive growth trend, Google also shows promise but at a more modest pace. Google Cloud's strategic approach, as outlined by Philipp Schindler, emphasizes leveraging AI-optimized infrastructure, Vertex AI for AI applications development, and smart integrations in its Workspace offerings. These initiatives, alongside its recognition as a leader in the Gartner Magic Quadrant for Strategic Cloud Platform Services, underline Google Cloud's commitment to integrating AI across its services, positioning it strongly for future growth and innovation in a burgeoning market.6. Management review

Google's management team is renowned for its strategic foresight and innovative culture, guiding the company to maintain its leadership in the tech industry. Their approach combines a strong focus on technological advancement with a commitment to ethical business practices and sustainability. This blend of innovation, ethical considerations, and strategic growth initiatives underpins Google's success and resilience in the face of industry challenges and competitive pressures. The team's ability to drive Google's mission forward while adapting to the ever-changing tech landscape is a testament to their effectiveness and visionary leadership.

Sundar Pichai, CEO of Alphabet Inc. and Google, is widely admired for his leadership and vision in steering the tech giant through an era of significant growth and innovation. Under his guidance, Google has not only solidified its dominance in search and online advertising but also made significant strides in cloud computing, hardware, and AI technologies. Pichai is known for his humble leadership style, focus on collaboration and innovation, and commitment to addressing complex challenges such as privacy, data security, and ethical AI use. His approach has been pivotal in maintaining Google's position at the forefront of the technology sector.

Sundar Pichai has faced criticism recently for Google's handling of its AI strategy, with some industry observers and investors questioning whether his leadership style is suitable for the rapidly evolving competitive landscape of artificial intelligence. Critics argue that Google, once a pioneer in AI, now seems to be lagging behind its competitors, attributing this shift to a perceived lack of strategic vision and decisiveness from Pichai. Concerns have been raised about Google's pace of innovation under his leadership, especially in comparison to rivals that have aggressively pursued AI advancements. Additionally, Pichai's management style, described as risk-averse and slow in decision-making, has been a point of contention, sparking debates about whether Google requires a more aggressive approach to reclaim its leadership position in AI and other key technology sectors.

While I can't predict the future, Sundar Pichai's track record suggests he has the potential to navigate through the criticism. His tenure at Google has been marked by significant achievements and the ability to lead the company through various challenges and transformations. The criticisms, primarily focused on Google's pace in AI advancements and decision-making processes, highlight areas where there's room for strategic shifts. Given Google's resources, Pichai's leadership qualities, and the company's history of innovation, there's a strong possibility that he could address these concerns by realigning Google's strategic priorities, particularly in AI, and potentially by adopting a more aggressive approach to innovation. Pichai's ability to adapt to the evolving tech landscape will be key in overcoming current criticisms.

Sundar Pichai owns 2,911,880 Class A shares of Alphabet and 22,348,940 Class B stock, as detailed in a comprehensive overview of Alphabet's major shareholders.

KEY TAKE-AWAYS

Under Sundar Pichai's leadership, Google has thrived, expanding into cloud computing and AI, despite facing criticism for its AI strategy and innovation pace. Pichai's strategic foresight and Google's culture of innovation suggest the company is well-equipped to address these challenges, particularly in AI. His ownership of significant Alphabet shares underscores his commitment and potential to steer Google through current critiques toward continued growth.7. Ownership

Alphabet boasts a sophisticated and multifaceted ownership structure that underscores its stature in the global tech arena. Institutional investors are the backbone of its shareholder base, commanding nearly 64% of outstanding shares, with giants like Vanguard Group and BlackRock leading the pack, holding 7.28% and 6.20% stakes, respectively. This institutional dominance, alongside significant holdings by State Street Corp, FMR LLC, and Geode Capital Management, reflects a deep market trust in Alphabet's strategic direction and its ongoing potential for growth.

Meanwhile, Alphabet's governance and strategic vision are significantly influenced by its individual shareholders, most notably its co-founders Larry Page and Sergey Brin, who possess 3.12% and 2.92% of Class A shares, respectively. Their leadership, alongside other key figures such as Eric E. Schmidt and John Doerr, intertwines with the company's genesis and evolution.

Alphabet's CEO, Sundar Pichai, though holding a comparatively modest 0.002% of Class A shares (227,560 shares), embodies the visionary leadership driving the company forward. This intricate blend of institutional support and insider guidance has enabled Alphabet to navigate the complexities of the tech industry, from dominating the search engine market to pioneering in AI, all while exploring new ventures under its 'other bets' initiative.

A recent filing with the SEC disclosed that Sundar Pichai, Alphabet Inc.'s CEO, divested 22,500 shares on April 3, 2024, at a mean price of $155.67 each, culminating in a gross sale of $3,502,575. Throughout the preceding year, Pichai has liquidated a cumulative 180,000 shares of Alphabet Inc, without acquiring any additional stock. The company's insider trading records over the last twelve months show a tendency towards selling rather than buying, with 61 instances of insider sales and not a single recorded purchase.

Insider transactions, like the sale of shares by a company's CEO, can be interpreted in various ways and don't necessarily signal a definitive trend regarding a company's health or future prospects. Sundar Pichai selling shares of Alphabet Inc. could be driven by personal financial planning needs rather than a lack of confidence in the company's future. It's also worth noting that even after such sales, insiders often retain a significant stake in the company, maintaining their interest in its success. This is also the case for Sundar.

KEY TAKE-AWAYS

Alphabet's ownership, dominated by institutional investors such as Vanguard Group and BlackRock, reflects market confidence in its growth and strategic direction. Key insiders like co-founders Larry Page and Sergey Brin add depth to its governance, emphasizing the company's strong foundation and innovative legacy. Despite CEO Sundar Pichai's recent share sales, Alphabet's blend of institutional backing and insider commitment underscores its ability to remain a leader in the tech industry, navigating through innovations and market challenges with resilience.8. Moats

Alphabet possesses considerable intangible assets, encompassing its mastery in search algorithms and artificial intelligence (AI), including both machine learning and deep learning. This expertise, coupled with its capability to gather and access advertiser-valuable data, positions Alphabet distinctively in the market. The Google brand itself is deemed an invaluable asset, with the phrase "Google it" becoming a universal term for internet searching, solidifying the perception of Google's search engine as the industry's leader, regardless of its technical superiority. Despite Microsoft's Bing leveraging AI technologies from OpenAI in an attempt to challenge Google, Alphabet is poised to maintain its search dominance through its own AI innovations, some of which underpin OpenAI's advancements.

Alphabet's network effects are attributed largely to its array of Google services, such as Search, Android, Maps, Gmail, and YouTube. This diverse portfolio has not only amassed a vast consumer base, enabling extensive data collection but also positioned Google advantageously for offering advertisers unparalleled returns on investment. The inclusion of new advertisers serves to enhance the efficiency of Google’s advertising solutions, further optimizing network monetization.

The efficacy of Google Search is derived from its ability to deliver increasingly relevant results, a process continually refined through the analysis of accumulated data, leading to predictive insights. Alphabet has adeptly monetized its technological innovations, from the foundational search algorithms to cutting-edge AI technologies now integral to almost all its offerings. Despite the uncertainties introduced by generative AI, Google's revenue prospects are anticipated to remain robust, benefiting from enhanced data insights for targeted advertising campaigns, potentially increasing advertiser spending per click.

The network effects extend beyond Google Search to include other services like Maps, Gmail, and Chrome, each enhancing user and advertiser value. For example, increased usage of Maps facilitates the collection of comprehensive traffic and commuting data, enabling more precise navigational suggestions. Similarly, Chrome's leading market position and Android's dominance in the smartphone sector, despite financial arrangements with companies like Apple and Samsung, bolster Google's network effect.

YouTube stands out as well, benefiting from network effects that attract both content creators and advertisers, given its extensive viewer base compared to other online video platforms. While Google is making inroads into the enterprise cloud market, its offerings in this space are not seen as driving network effects to the extent of its other products. Nonetheless, Google's technological prowess, especially in AI, is expected to support its position in the cloud sector, trailing only behind Amazon Web Services and Microsoft Azure.

Alphabet's strategic investments in emerging technologies, including health tech through Verily and autonomous vehicles via Waymo, highlight its commitment to innovation. Although these "other bets" are yet to significantly contribute to Alphabet's economic moat, they underscore the company's forward-looking approach and its potential for sustained economic profitability through Google.

One could argue that Google has created the perfect "Lollapalooza effect," as introduced by Charlie Munger. The "Lollapalooza effect" refers to a situation where multiple factors or tendencies act together in the same direction to produce an extraordinarily positive outcome. It's essentially the convergence of several positive forces that create an outcome far greater than the sum of their parts. Google, with its diversified yet interconnected business model, indeed exhibits a Lollapalooza effect, particularly through its network effects and strategic focuses:

Network Effects: Google’s services, including its search engine, YouTube, Android, and Google Maps, benefit significantly from network effects. As more users engage with these services, the value of the network increases for all participants. For Google Search, more users generate more data, improving search algorithms and results. For YouTube, a larger audience attracts more content creators, which in turn draws in more viewers, creating a virtuous cycle that enhances the platform's value for users and advertisers alike.

Focus on Customer and Partner Success: Philipp Schindler's emphasis on making Google’s customers and partners successful is a key strategy. By focusing on maximizing their growth, Google not only enhances its ecosystem but also reinforces its competitive moats. This approach ensures that customers and partners are more likely to stay within the Google ecosystem, contributing to a sustainable financial model that feeds back into Google’s growth and innovation cycle.

YouTube's Creator Success: YouTube’s strategy to "try everything to make the creator successful" serves as a potent example of the Lollapalooza effect. By providing tools, resources, and monetization options to creators, YouTube ensures a continuous stream of diverse and engaging content, which attracts a large and varied audience. This audience, in turn, draws advertisers willing to pay a premium to reach potential customers, thereby generating substantial revenue for both creators and YouTube. The success of creators fuels the platform’s growth, enhancing YouTube's attractiveness to new creators and advertisers, thereby perpetuating the cycle.

In essence, Google's business model, characterized by strong network effects and a strategic focus on the success of its customers, partners, and content creators, exemplifies the Lollapalooza effect. This convergence of positive forces not only solidifies Google’s dominant position in the markets it operates but also enables the company to navigate challenges and capitalize on opportunities for continued growth and innovation.

KEY TAKE-AWAYS

Alphabet's prowess in search algorithms and artificial intelligence, along with its unparalleled data collection, sets it apart in the digital market, with the Google brand being a significant asset. Its vast array of services, including Search, Android, Maps, Gmail, and YouTube, creates a robust network effect, enhancing its appeal to advertisers and optimizing monetization. Alphabet's commitment to innovation is evident in its strategic investments in emerging technologies like health tech and autonomous vehicles, showcasing its potential for sustained profitability and market leadership despite the challenges from competitors like Microsoft's Bing.9. Financial performance

The story of Alphabet, Google's parent company, is a fascinating journey of innovation, strategic acquisitions, and expansion into new markets, all of which have contributed to its stellar financial performance over the years. Here's a concise overview of how Alphabet emerged as a tech giant:

Founding and Initial Focus on Search (1998): Google Inc. was founded by Larry Page and Sergey Brin while they were Ph.D. students at Stanford University. The company's initial focus was on improving internet search, which was achieved through their development of the PageRank algorithm, significantly enhancing the relevance of search results.

Expansion and Diversification: Throughout the early 2000s, Google expanded its product lineup beyond search to include email (Gmail), mapping (Google Maps), and productivity tools (Google Docs and Sheets).

2006: Google acquired YouTube, the largest video-sharing platform, marking a significant step into the world of online content.

2007-2008: The launch of Android and the subsequent development of the Google Play Store marked Google's entry into the mobile operating system market, dramatically expanding its influence

Strategic Acquisitions: Google made several strategic acquisitions, including DoubleClick for online advertising, Nest Labs for smart home products, and Waze for community-based traffic and navigation, among others. These acquisitions broadened Google's product portfolio and data capabilities.

Foray into Hardware and Cloud Computing: The company ventured into hardware with its Nexus devices, Google Home speakers, and later, the Google Pixel smartphone line. Google Cloud Platform was launched, offering cloud computing services and competing with the likes of Amazon Web Services and Microsoft Azure, further diversifying its revenue streams.

Alphabet Inc. Formation (2015): Google restructured under a new parent company, Alphabet Inc., to provide greater transparency and focus on its diversified business interests. Alphabet became the umbrella company for Google's core internet products and other ventures, now referred to as "Other Bets," which include Waymo (autonomous vehicles), Verily (life sciences), and DeepMind (AI).

Alphabet's financial performance has been marked by consistent revenue growth, largely driven by its dominance in online advertising through Google Search and YouTube, as well as its expanding cloud computing services. Despite the investment in long-term bets, which have yet to turn profitable, the core advertising business and growing cloud segment have fueled Alphabet's financial success.

This journey has led to the following financial performance:

Alphabet has one of the best financial track records in the world with consistent topline- and profitability growth. The source of growth has been both organic and inorganic. A pure sign of the strong MOAT which is likely not going to deteriorate in the future. Alphabet is estimated to follow similar growth trend the next couple of years, according to analysts.

Double-clicking on the profitable growth shown on the first graph, it is evident that Alphabet has been able to add more FTEs and ‘squeeze’ more revenue out of each individual while maintaining a low cost base. Revenue per FTE has grown faster than overhead costs (SGA and R&D) which is a sign of great cost management as well as a sign of its successful strategic plays in terms of new products and services (e.g., acquisitions and ‘Other Bets’). COGS per FTE has grown faster (4.8% vs. 3.5%) the past decade, but on a 5 year basis, revenue per FTE has grown faster than COGS per FTE (4.8% vs. 5.5%).

‘Per Share Items’ development also indicate that Google’s profitable growth has been sustainable; e.g., 'Revenue per Share' and 'Book Value per Share' suggest that Google is efficiently growing its revenues while simultaneously increasing its equity value at a comparable pace. This balance is indicative of healthy financial management and suggest that Google is likely achieving growth without disproportionately increasing its debt or diluting equity. This is also a signal of efficient use of capital.

Solid margin performance. Latest financial year performance in line with 10 year averages. Latest estimates for 2024E-2026E include the following:

EBITDA margin: 36.6% (‘24E), 37.0% (‘25E), and 33.5% (‘26E)

EBIT margin: 28.7% (‘24E), 29.3% (‘25E), and 28.3% (‘26E)

Moreover, 'Net Income Margin' and 'Free Cash Flow Margin' has hovered around the same levels the past decade which generally indicate a strong correlation between the Alphabet’s profitability and its ability to generate cash after accounting for capital expenditures. Hence, it is an indication that the Alphabet is not only profitable but also good at converting those profits into free cash flow. This is crucial for dividends, debt repayment, reinvestment, and handling unforeseen expenses without needing to secure external funding.

Alphabet’s SGA relative to Gross Profit has been on a declining trend the past decade which may indicate that Alphabet is becoming more efficient in its operations. Reducing the ratio of SGA to gross profit suggests that it is controlling costs better or becoming more streamlined in how it manages overhead, marketing, sales efforts, and general administrative functions.

Alphabet has been increasing ROE (Return on Equity), ROA (Return on Assets), ROCE (Return on Capital Employed), ROIC (Return on Invested Capital), and ROOA (Return on Operating Assets) since 2014. This is generally indicating that Alphabet is improving its profitability and using its resources more efficiently to generate returns. These metrics suggest strong management performance in deploying assets and capital to maximize shareholder value, reflecting an overall improvement in financial health and operational performance. ROIC and ROCE are well above WACC in all years, which is a clear signal of value creation.

Above ratios collectively indicate that Alphabet maintains a conservative financial strategy characterized by strong equity financing and minimal reliance on debt. This conservative approach reduces financial risk and positions Alphabet well to manage potential economic volatility, supporting sustained growth and investment in innovation.

Alphabet has the past decade invested a significant portion of its revenue, EBIT, and operating cash flow back into capital expenditures. This suggests a strong focus on expanding and upgrading its operational capabilities, infrastructure, and technology development to support growth and innovation. Such investment levels highlight Alphabet’s commitment to maintaining and enhancing its competitive position in the technology sector.

Above liquidity ratios suggest that Alphabet has significantly more assets than liabilities, with a substantial portion in easily accessible forms such as cash or near-cash items. This means Alphabet is well-equipped to meet its short-term obligations and has ample financial flexibility to handle unexpected financial needs or investment opportunities.

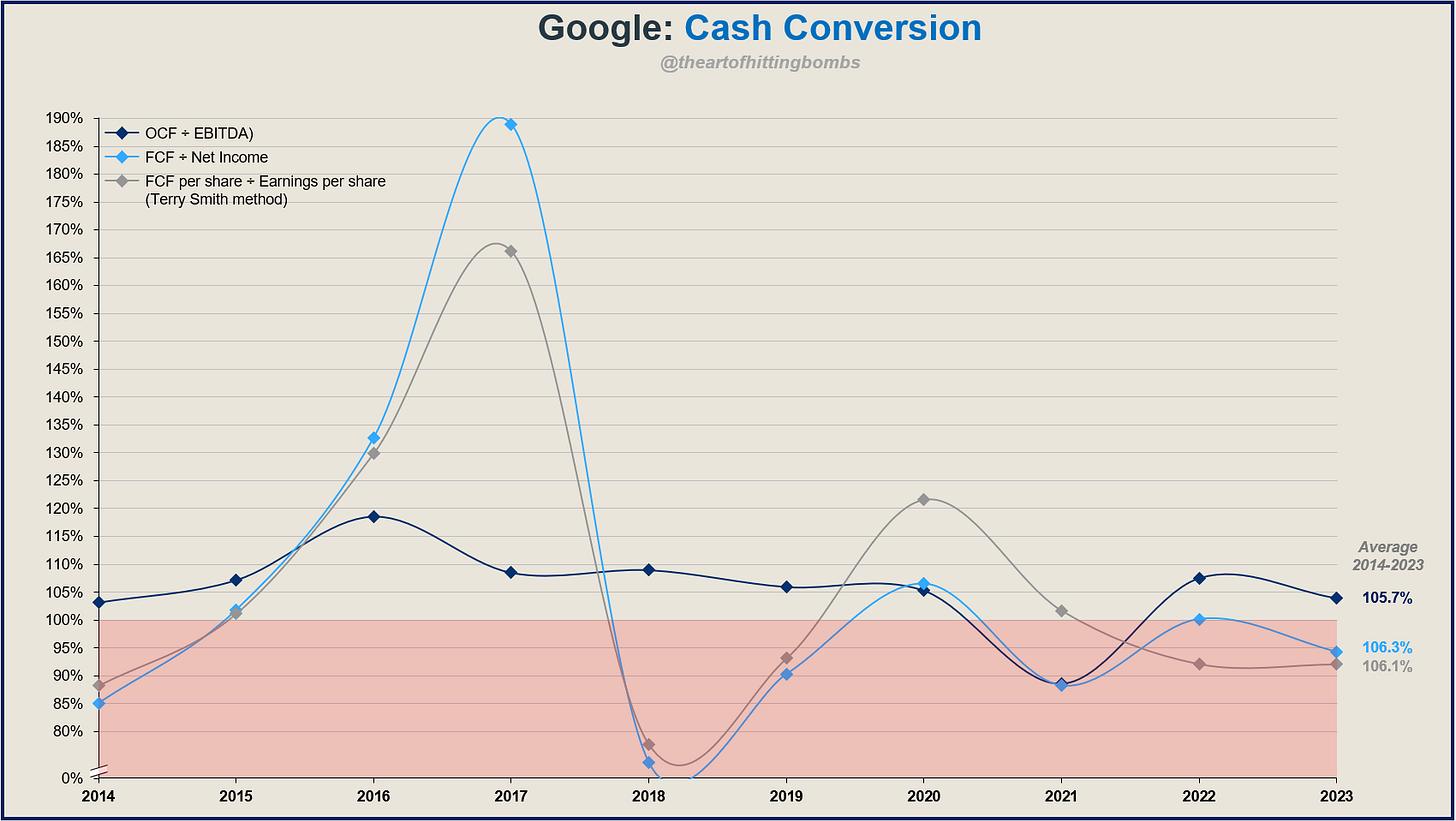

Alphabet is highly effective at converting its earnings into cash flow. Above versions of cash conversions reflects strong operational efficiency and suggests that Alphabet manages its working capital well, generating more cash than its net income, which is beneficial for funding operations, investments, and returning value to shareholders.

KEY TAKE-AWAYS

Alphabet's financial metrics underscore its strong performance and prudent management. The company has shown consistent growth in profitability and asset efficiency, with increasing returns on equity, assets, and invested capital. It has maintained a conservative financial strategy, characterized by strong equity financing and minimal debt, ensuring financial flexibility and stability. The company's significant investment in capital expenditures reflects its commitment to innovation and maintaining a competitive edge in technology.

Overall, Alphabet's journey highlights a well-managed conglomerate with a clear strategic vision, strong operational execution, and a solid financial foundation, positioning it well for sustained growth and innovation in the future.10. Capital allocation and Value Creation

Capital allocation refers to the process through which a company decides how to use its financial resources to maximize shareholder value. Alphabet's capital allocation strategy is characterized by a balanced approach between aggressive investment in growth initiatives and maintaining a strong financial foundation. By prioritizing innovation, strategic acquisitions, and shareholder returns, management of Alphabet has effectively utilized capital allocation to position Alphabet as the leader in the technology sector. Below show how capital has been allocated the past decade.

Historic Cash Outflows

Largest cash outflows of Alphabet past decade has been investments, buybacks, and CAPEX. It seems like buybacks has been an increasingly important focus for Alphabet management, as the share of total outflows has been increasing since 2014, and ended up accounting for 31% of total outflows in 2023 ($61.5 billion).

The declining "Purchase of Investments" alongside increasing share buybacks in Alphabet's cash flow statement indicates a strategic shift in capital allocation. Alphabet is reducing its investment in external assets or securities, possibly due to lower expected returns or a change in investment strategy, and is instead choosing to return more capital to shareholders through buybacks. This could signal confidence in the company’s current financial health and future prospects, suggesting that Alphabet believes investing in itself offers a better return on investment. Additionally, buybacks can help increase earnings per share and enhance shareholder value, indicating a focus on supporting stock prices and rewarding shareholders.

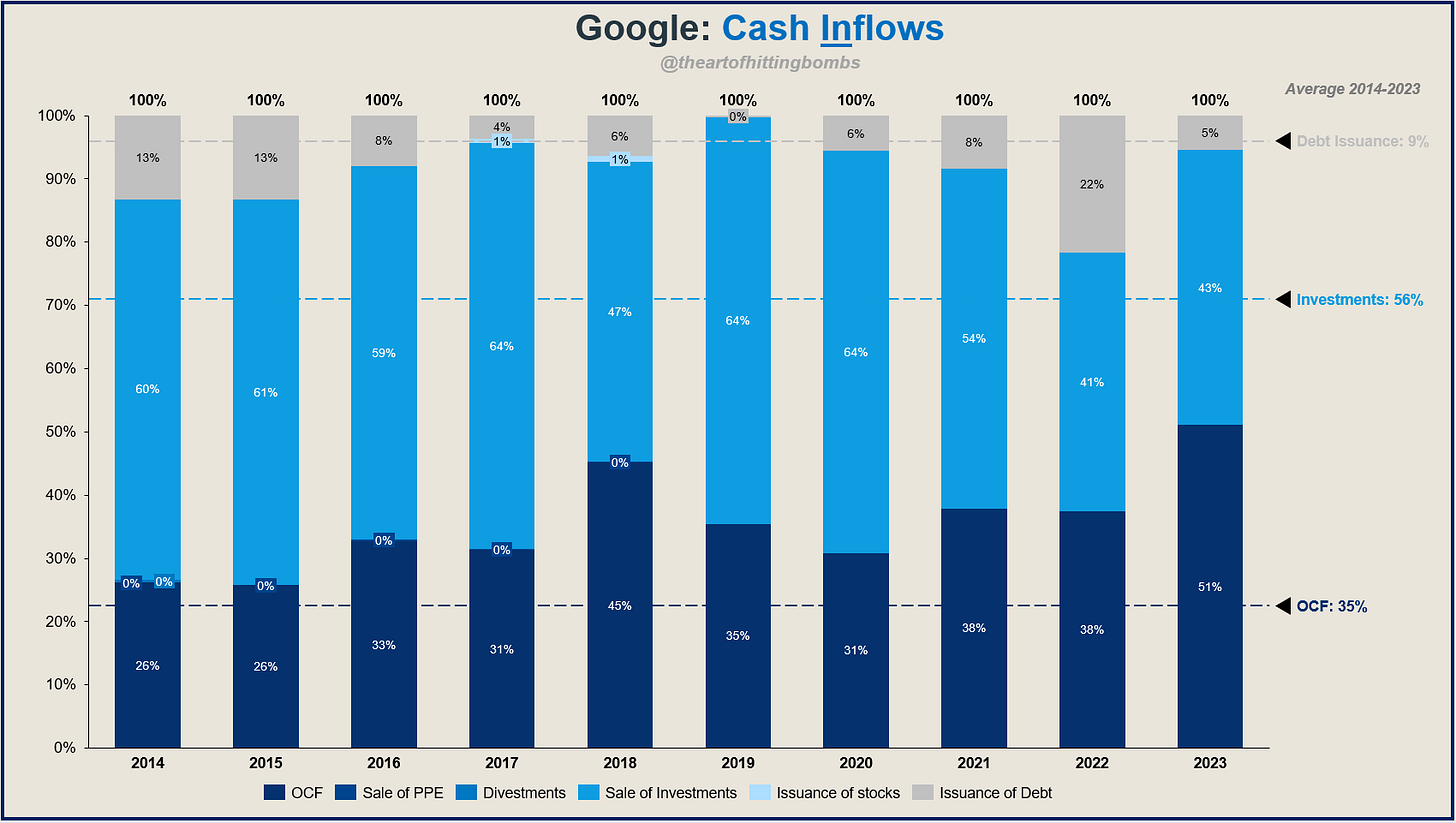

Historic Cash Inflows

Alphabet's cash flow statement show that on average 35% of cash inflows come from operating cash flow, 56% from investments, and 9% from debt issuance. This distribution indicates that Alphabet has strong operational efficiency and profitability, generating a substantial portion of its cash from everyday business activities. The largest share of cash inflows is from returns on investments and the liquidation of investment assets, suggesting Alphabet actively manages a significant portfolio that contributes notably to its cash resources. The portion from debt issuance, though smaller, reflects a strategic and conservative approach to leveraging debt financing relative to its operational earnings and investment returns. These figures highlight Alphabet's robust cash generation capabilities, effective investment management, and prudent financial strategies, all supporting its financial stability and capacity for pursuing growth initiatives.

The consistent decrease in Alphabet's diluted shares outstanding, with an accelerated pace over the past three years, indicates (again) a strong and increasing commitment to share buybacks. This strategy enhances shareholder value by increasing earnings per share and typically supports a rise in stock prices by signaling confidence in the company’s financial health and prospects. It suggests that Alphabet prioritizes returning value to shareholders and effectively managing its capital structure.

The chart above illustrates (again) Alphabet's intensified focus on share buybacks over the past decade, with buyback activity reaching its peak between 2022 and 2023, a period during which GOOGL's share price fell by 45%. This could indicate a display of strong management acumen in enhancing shareholder value, aligning with Warren Buffet's principles on buybacks. Buffet advocates that value is preserved by avoiding buybacks at prices above the stock's intrinsic value, suggesting that Alphabet's management may have capitalized on the lower share price to buy back stock more economically, thereby potentially increasing long-term shareholder value.

Another measure to assess Alphabet’s capital allocation performance and whether they have created value for shareholders is by looking at the CFROI against Cost of Capital. Three different methods of CFROI has been used. Here, it is evident that Alphabet has been creating much value for shareholders past 10 years.

KEY TAKE-AWAYS

Alphabet's capital allocation strategy effectively balances aggressive growth investments and maintaining a solid financial base. Over the past decade, Alphabet has focused its largest cash outflows on investments, buybacks, and capital expenditures, with buybacks growing to represent 31% of total outflows in 2023. This shift towards increasing buybacks, especially during a period of lower share prices, highlights Alphabet’s strategic financial management aimed at boosting shareholder value by optimizing the timing and price of share repurchases.

Overall, Alphabet's strategic capital deployment and financial maneuvers have successfully driven long-term shareholder value creation, ensuring financial stability and positioning the company for continued leadership in the technology sector.11. Valuation

I've consistently prioritized business fundamentals over charts in investing, but integrating chart insights with fundamental analysis can reveal historical buying and selling patterns. This combined approach enhances understanding of market momentum and future trends. It’s not about timing the market, but about buying strong companies at reasonable prices.

*Based on numbers from 14-04-2024.

Current trading multiples/ratios compared to peers

Current trading multiples of Alphabet (GOOGL share price: $157.76) can be seen below. Comparing those multiples to Alphabet’s direct and indirect competitors, we get the following trading multiples/ratios:

Alphabet seems relative fairly priced compared to peers. It must however be noted that selected peers are not perfectly comparable to Alphabet, but serve largely as proxy.

Historic trading multiples

Alphabet is trading around historic averages on sales, earnings, and FCF. From a technical-fundamental point of view, Alphabet may increase in value going forward and reach pandemic high multiples, if US tech stocks continue its current greed! Only time will tell. I engaged in buying shares from September 2022 through February 2023.

DCF valuation and FCF Yield short-term scenarios

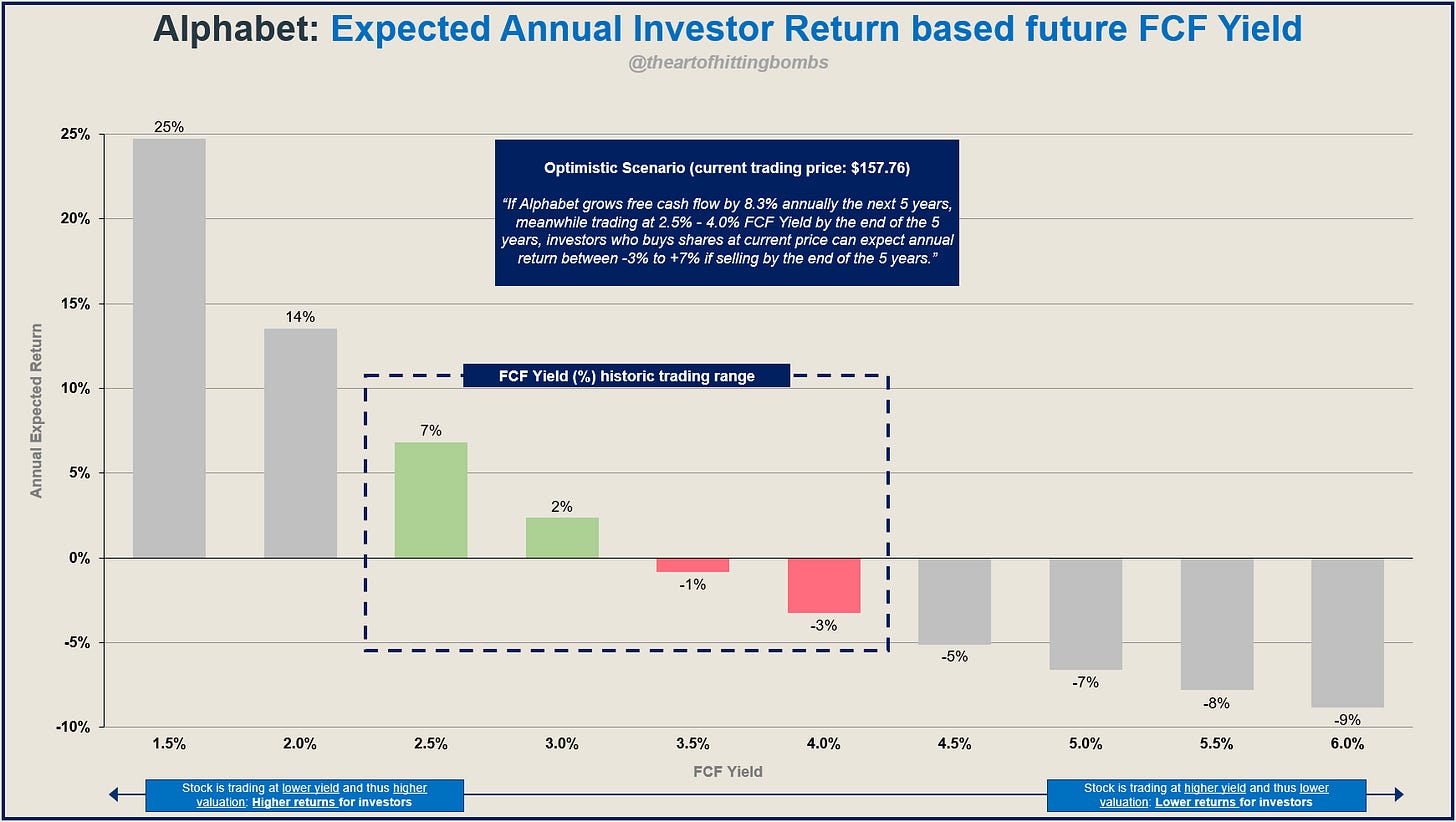

To triangulate the findings, two DCF valuations have been created to assess Alphabet’s attractiveness at current price levels.

Scenario 1: Optimistic case

From an optimistic perspective, Alphabet seems relatively undervalued to some degree. More like fairly valued.

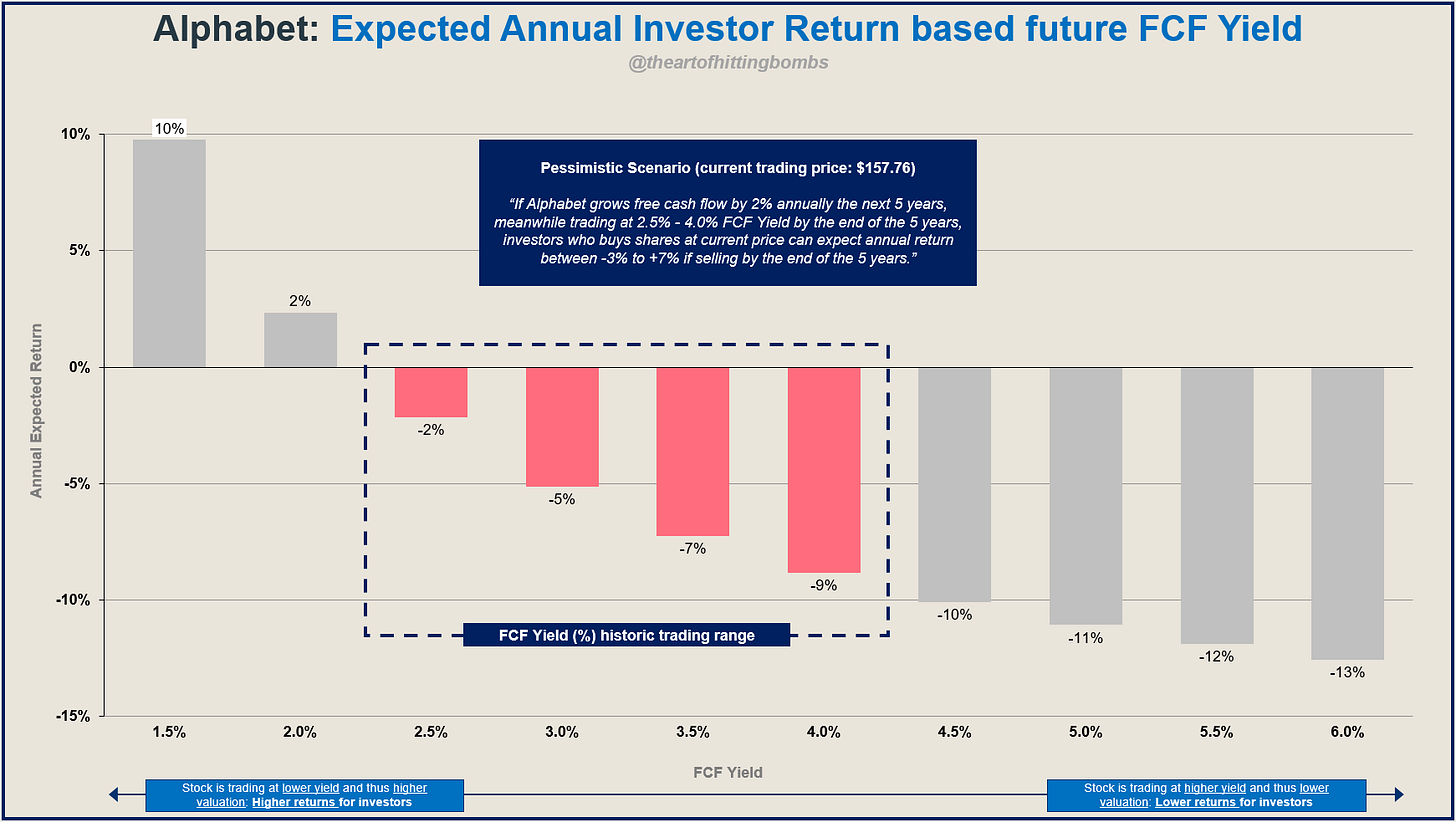

This scenario has built in that Alphabet will reverse its slowing growth trends past three years, and start growing faster in the short-term. Alphabet will also withstand new entrants to the industry and will not be impacted by e.g., OpenAI and other AI generative solutions. Market shares will be taken within the cloud industry. Margins are stable and higher than historic performance. Given this, GOOGL should be trading at around $172.76 a share, and investors could expect low annual returns (-3% to +7%) if buying a today’s prices and sells in 5 years. I would not say there is a margin of safety from this perspective, but sometimes one would need to adhere to Charlie Munger’s famous quote: “A great business at a fair price is superior to a fair business at a great price.”

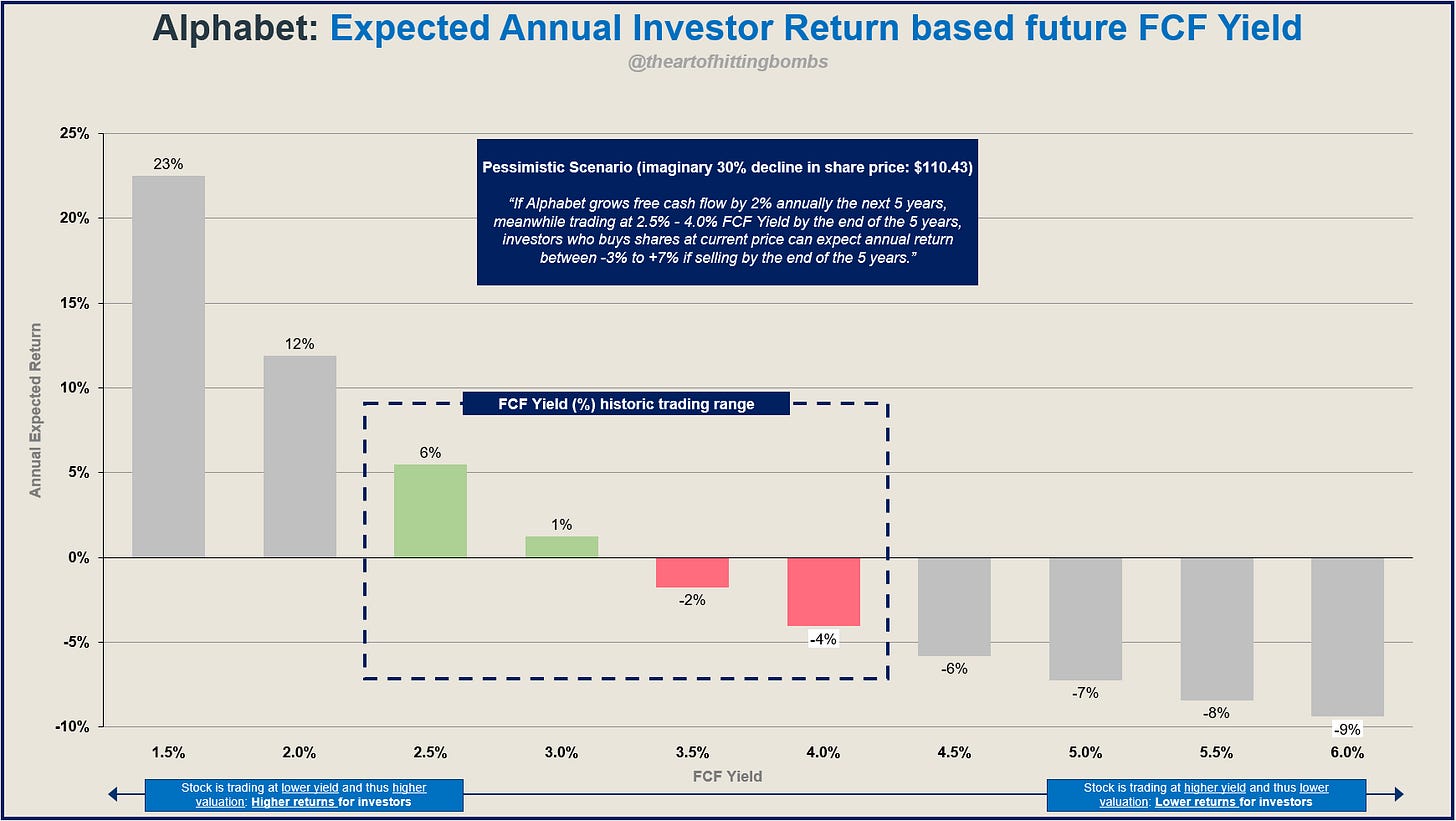

If we use same optimistic scenario, and pretend that GOOGL shares would decline 30% from today’s prices because of noise in the market (e.g., OpenAI or Google’s slow response to AI), investors can expect annual returns of +4% to +18% if selling in 5 years AND Alphabet continues to be selling at a premium (FCF Yield of e.g., 2.5% to 4.0%).

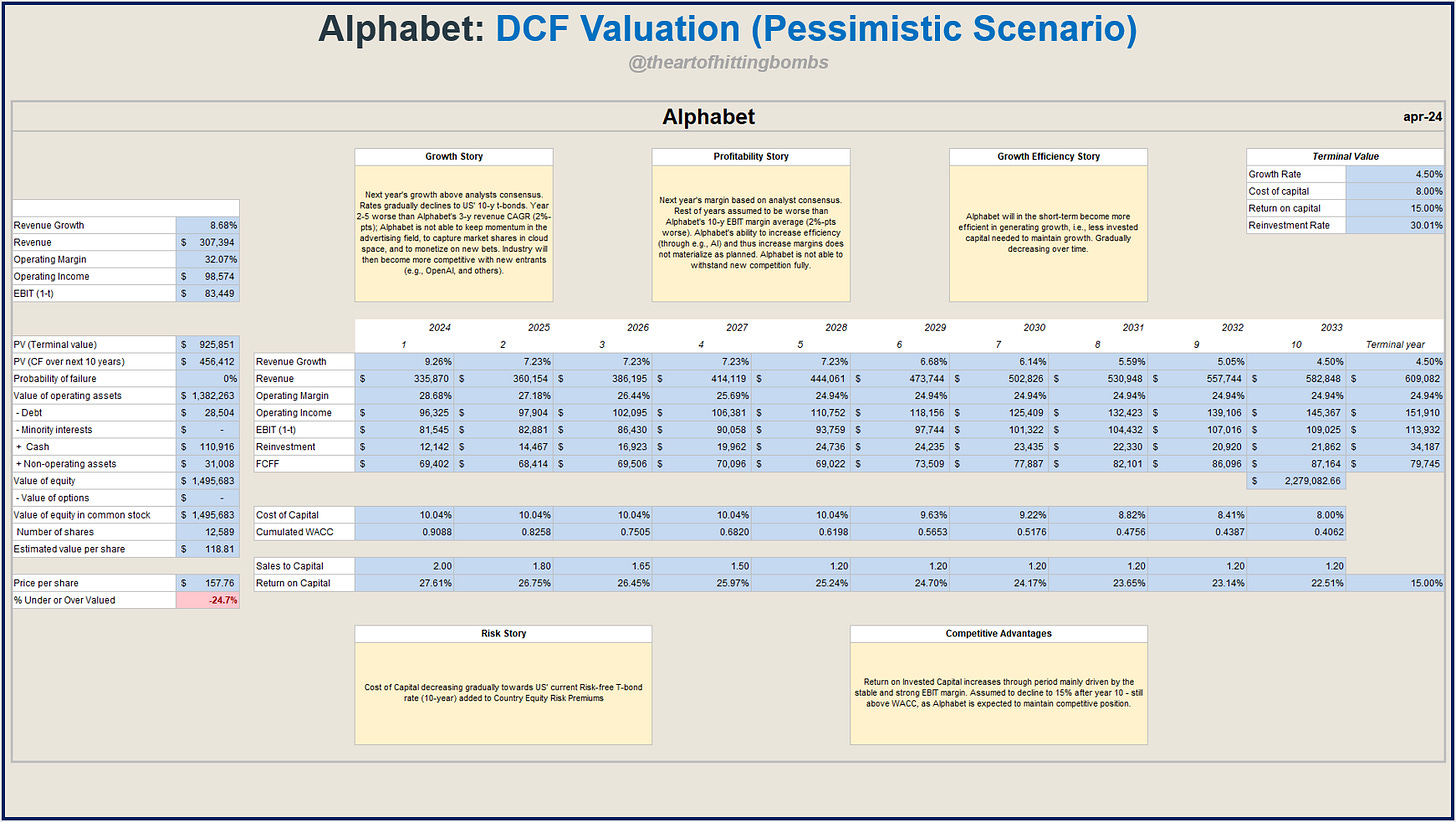

Scenario 2: Pessimistic case

From a pessimistic perspective, Alphabet seems overvalued. This scenario is building on the story that Alphabet cannot pick up topline growth and the projected margins for 2024 is according to analysts’ estimates and will then decrease to below 10-y average. Alphabet is not able to keep momentum in the advertising field, to capture market shares in cloud space, and to monetize on new bets. Industry will become more competitive with new entrants (e.g., OpenAI, and others). If investors believe in this story, they should only pay $118.81 per share. FCF Yield exemplifies the overvaluation and investors cannot expect positive annual returns, only if Alphabet would be trading at a FCF Yield of 2.0% or below.

An imaginary 30% decline of GOOGL shares would help investors in this pessimistic scenario, but again, low annual returns could be expected if selling by the end of 5 years.

KEY TAKE-AWAYS

Overall, Alphabet appears to be trading at fair value based on various valuations. Current prices don't provide a margin of safety to offset potential future uncertainties, such as Alphabet's ability to accelerate revenue growth or the impact of competitors. There has been significant momentum (and greed) in US tech stocks over the past year, and ideally, this will moderate, presenting more attractive opportunities for investors.12. Short- and long-term challenges

Navigating the intricate landscape of today's tech industry, Google confronts a spectrum of challenges and competitive pressures that shape its strategic direction and operational focus. From its heavy reliance on advertising revenues to the imperative of continuous innovation amidst fierce competition, the company's journey is fraught with complexities. This exploration delves into the multifaceted risks Google faces, including the dynamics of new ventures, intellectual property concerns, and the intricacies of international operations, offering a comprehensive view of the hurdles in Google's path to sustained growth and market leadership. Below are the main risks specific to Google and the industries they operate within (non-exhaustive list):

Advertising Revenue Risks: Google's reliance on ad revenue makes it vulnerable to reduced ad spending, ad-blocking technologies, and changes in advertising and data privacy practices.

Competition and Innovation: The company must continuously innovate to stay ahead in a rapidly evolving and competitive market, including advancing AI technology amidst fierce competition and potential legal and technical challenges.

Investments in New Ventures: Google's expansion into new businesses and technologies, while necessary for growth, carries risks of unviability, unanticipated liabilities, and could divert focus from current operations.

Revenue and Margin Pressure: Factors such as changing user access methods, advertiser spending shifts, and regulatory changes could slow revenue growth and put pressure on operating margins.

Intellectual Property and Branding: Protecting intellectual property and maintaining strong brand identities are critical, with risks from legal challenges and market perception potentially impacting Google's competitive edge.

Manufacturing and Supply Chain: Dependence on third-party manufacturers and global supply chains exposes Google to risks from disruptions, quality control issues, and escalating costs.

Technology and System Failures: The complexity of Google's IT and communications systems introduces risks of service interruptions, security vulnerabilities, and data loss.

International Operations and Currency Risks: Google's global operations are subject to regulatory, political, and economic risks, including foreign exchange fluctuations.

Device and Platform Compatibility: Google's success depends on the widespread adoption of its products across diverse and evolving devices and platforms. Failure to ensure compatibility and user adoption could negatively impact its business.

AI Development Risks: Innovations in AI could lead to ethical dilemmas, legal liabilities, and reputational damage due to issues like harmful content, privacy breaches, and cybersecurity risks.

Data Privacy and Security: Concerns over data handling and security breaches could damage Google's reputation and lead to significant legal liabilities and user distrust.

Content Quality and Misuse: Ongoing investments in platform security and content review are crucial for addressing misuse and ensuring the quality of user-generated content, which is vital for maintaining user trust and engagement.

Internet Access Dependency: Google's operations rely on unrestricted internet access. Any access restrictions imposed by internet providers could incur additional costs and reduce user and advertiser engagement.

KEY TAKE-AWAYS

As Google navigates the complexities of the digital age, it faces a myriad of challenges across various aspects of its operations. From advertising revenue risks to the nuances of AI development, each factor presents unique hurdles. Yet, these challenges also offer opportunities for growth, innovation, and leadership in the tech industry. Google's journey forward will undoubtedly require a delicate balance of risk management and strategic innovation, as it continues to shape the future of technology and global connectivity. Google has since day 1 faced fierce competition, as well as industry- and company-specific risks, and they have managed to thrive in such environment and take advantage of any arising opportunities.13. Opportunities going forward: Why Google’s Recent missteps will not derail its long-term potential

Googles recent setbacks are unlikely to hinder its long-term prospects. With a commanding 90% global market share (over 80% in the U.S.) in online search, Alphabet, through Google, continues to generate substantial cash flow. Confidence remains high that Google will preserve its market leadership, even as Microsoft enhances Bing with generative AI, and despite Google's recent AI challenges. Additionally, contributions from YouTube and Google Cloud are anticipated to increasingly bolster the company's financial performance.

The expansion of Google's ecosystem, driven by growing user adoption of its products, enhances the appeal of its online advertising services to both advertisers and publishers. Owing to its dominant position, Google possesses a wealth of consumer behavior data, enabling it to refine search relevance and ad effectiveness. Alphabet's commitment to technological innovation, including AI utilization in search, aims to enrich user experience across its suite of products and streamline ad transactions. Although the advent of generative AI introduces some uncertainty, Google's data advantage is expected to sustain its search dominance. Despite the business reaching maturity, advertising revenue is projected to grow at mid-single-digit rates in the forthcoming years, according to Morningstar analysis.

In its investment endeavors, Google has effectively harnessed its private cloud technology expertise to make inroads into the public cloud sector, achieving market share gains that contribute to revenue growth and operating leverage, with expectations for continued progress. Google reported for the first in FY2023 a positive operating result for their cloud segment.

While many of Alphabet's forward-looking projects are yet to produce revenue, the potential rewards are significant, particularly in new market segments. Waymo's autonomous vehicle technology is a prime example, with the potential to access a market worth tens of billions of dollars in the next decade or so, as indicated by various studies.

Deep-dive into Google’s recent missteps: How big is the threat from competitors, following the recent development of generative AI?

If you look at SeekingAlpha (as of 06-04-2024), which bolsters great analysts around the globe, there seem to be confusion about the impact of ChatGPT and generative AI:

To set things into perspective and maybe a key reminder to you all (including myself), I will here refer to Google’s previous work within the AI space and the fact that AI is much more than just generative AI (such as GPTs). AI encompasses much more than just generative AI. It includes a wide array of technologies and methodologies designed to enable machines to simulate human intelligence processes. Here are some key types of AI beyond generative AI: Machine Learning (ML), Deep Learning, Natural Language Processing (NLP), Computer Vision, Robotics, Expert Systems, and Reinforcement Learning. Generative AI (under NLP), known for generating content like text, images, and music that mimics human-created content, is just one of the many facets of AI. Each type of AI has unique applications and contributes to the advancement of technology in different ways.

Alphabet mention in their 10-K for FY2023 that they have been in the AI space since 2001. More than two decades. Here is a snip from Google’s AI initiatives:

“Making AI Helpful for Everyone

AI is a transformational technology that can bring meaningful and positive change to people and societies across the world, and for our business. At Google, we have been bringing AI into our products and services for more than a decade and making them available to our users. Our journey began in 2001, when machine learning was first incorporated into Google Search to suggest better spellings to users searching the web. Today, AI in our products is used by billions of people globally through features like autocomplete suggestions in Google Search; translation across 133 languages in Google Translate; and organization, searching, and editing in Google Photos.

Large language models (LLMs) are an exciting aspect of our work in AI based on deep learning architectures, such as the Transformer, a neural network architecture that we introduced in 2017 that helped with language understanding. This led to the Bidirectional Encoder Representations from Transformers, or BERT, in 2019 that helped Search understand the intent of user search queries better than ever before.

Google was a company built in the cloud, and we continue to invest in our Google Cloud offerings, including Google Cloud Platform and Google Workspace, to help organizations stay at the forefront of AI innovation with our AI-optimized infrastructure, mature AI platform and world-class models, and assistive agents.

We believe AI can solve some of the hardest societal, scientific and engineering challenges of our time. For example, in 2020, Google DeepMind’s AlphaFold system solved a 50-year-old protein folding challenge. Since then, we have open-sourced to the scientific community 200 million of AlphaFold’s protein structures which are used to work on everything from accelerating new malaria vaccines to advancing cancer drug discovery and developing plastic-eating enzymes. As another example, AI can also have a transformative effect on climate progress by providing helpful information, predicting climate-related events, and optimizing climate action. Using advanced AI and geospatial analysis, Google Research has developed flood forecasting models that can provide early warning and real-time flooding information to communities and individuals.

As AI continues to improve rapidly, we are focused on giving helpful features to our users and customers as we deliver on our mission to organize the world’s information and make it universally accessible and useful. With a bold and responsible approach, we continue to take the next steps to make this technology even more helpful for everyone.” —— SEC

In sum, Google's AI strategy is marked by a deep commitment to leveraging AI not just for enhancing natural language processing but for a broad spectrum of applications that offer societal, scientific, and organizational benefits, underlining its mission to make information universally accessible and useful.

“Deliver the Most Advanced, Safe, and Responsible AI

We aim to build the most advanced, safe, and responsible AI with models that are developed, trained, and rigorously tested at scale powered by our continued investment in AI technical infrastructure. In December 2023, we launched Gemini, our most capable and general model. It was built from the ground up to be multimodal, which means it can generalize and seamlessly understand, operate across, and combine different types of information, including text, code, audio, images, and video. Our teams across Alphabet will leverage Gemini, as well as other AI models we have previously developed and announced, across our business to deliver the best product and service experiences for our users, advertisers, partners, customers, and developers.

We believe our approach to AI must be both bold and responsible. That means developing AI in a way that maximizes the positive benefits to society while addressing the challenges, guided by our AI Principles. We published these in 2018, as one of the first companies to articulate principles that put beneficial use, users, safety, and avoidance of harms above business considerations. While there is natural tension between being bold and being responsible, we believe it is possible — and in fact critical — to embrace that tension productively.” —— SEC

Google's approach to AI, emphasizing both boldness and responsibility, is essential for long-term success, especially in light of rapid advancements in technologies like generative AI and the proliferation of false information. By prioritizing the development of AI to maximize societal benefits while mitigating challenges, Google adheres to its AI Principles established in 2018, emphasizing user safety, beneficial use, and harm avoidance over mere business gains. This strategy not only navigates the inherent tension between innovation and ethical considerations but also positions Google to lead sustainably in the AI domain. Embracing this tension productively is crucial for ensuring that AI advancements continue to serve society positively, maintaining user trust and setting a standard for responsible AI development in the tech industry. It may be that Google have been taking slowers steps in response to ChatGPT, but at least they do it responsibly. For long-term investors, this is hugely important.

Another perspective is to assess how Google’s Philipp Schindler (SVP and Chief Business Officer of Google) responded to questions in relation to the recent missteps at the Morgan Stanley Technology, Media, and Telecom Conference on March 6th, 2024:

1) On Gemini’s short-term issues:

“Yeah. Look, you're talking about the bias that some of our models on the image side and on the text side have shown, and we publicly said this is obviously completely unacceptable. And the teams have really been working around the clock to fix this, and we're seeing substantial progress already. We're doing also a very, very deep postmortem to truly understand all the different nuances of this. Sundar has been very clear in saying that we're driving very, very active changes, and will be driving very active changes from this. It could be structural changes. It could be changes in how we think about product launch guidelines, product launch processes, eval processes, red teaming, and so on and so on. So, a very, very deep analysis going on of this incident.

The reality, though, and that's important to keep in mind, is we know how to launch great products. We know how to build great products. And if you think about the expertise that we have, not only on the product side, but also on the technical infrastructure side, if you think about the expertise that we have on the research side, we have two of the greatest research teams in the world that we a while ago combined into one under Demis's* leadership, and they're a full part of our company. I'm 100% convinced that really the best of AI is yet to come. Very exciting times ahead.”

*Demis Hassabis is a British artificial intelligence researcher, neuroscientist, video game designer, entrepreneur, and co-founder and CEO of DeepMind Technologies, a company specializing in artificial intelligence (AI) and deep learning. DeepMind was founded in London in September 2010 by Demis Hassabis along with Mustafa Suleyman and Shane Legg. The company quickly became one of the leading organizations in AI research globally. In 2014, Google acquired DeepMind for around $500 million, and it now operates as part of Alphabet Inc., Google's parent company. Under the umbrella of Alphabet, DeepMind continues its research in AI, making significant contributions to the field, including advancements in deep learning, neural networks, and reinforcement learning.

2) On Alphabet moving too slow when it comes to AI:

“Look, we've been the leader in AI for many, many years, and we have made a very conscious decision to not rush the launch of a chatbot. If you look at our size, if you look at our scale, if you look at billions of users that rely on us, that was a very, very conscious decision we made. You look at how we have increased our innovation rate, or just look at the innovations that we've launched since, let's say, last December. You look at all the different -- the family of Gemini – really breakthrough multimodal models. You look at how we upgraded Bard, now called Gemini, with our 1.0 Ultra model. A very capable model. You look at what we've done -- and again, this is all in the last few months. You look at our lightweight open-source Gemma models we just announced. You look at our Gemini 1.5 Pro model with a breakthrough in the long context window, and I'm not sure how much attention you've all really paid to this, but if you really start working with a long context window of like a million tokens, which is a significant factor X versus anything that has ever been out there, and I think in the labs we've even taken it to 10 million tokens.

It is completely stunning in terms of the video input, the large data input, multiple books, whatever you want to feed in there. It is really a fundamental breakthrough that you're seeing.

But going to your question, in some areas, for example, on the Search side, you look at some of the SGE launches, we're running them more in an experimental state. That's why we launched them as part of Search experiments and not fully out to the world yet, because obviously it touches our core product Search, and that's why we want to make sure really, really sure that we have something that every user finds helpful, is trustworthy, and delivers on this super highest quality level that people actually expect from something like our core product Search.”

3) On the ‘innovator’s dilemma’ and when the bigger models will be put into Search and whether Search could change:

“We had concerns about Search for a very long time. This is not something -- remember, if you go back, you think about the concerns about mobile apps. You think about the concerns around social search. You think about the concerns around e-commerce sites. Those were all very serious concerns at the time. And I think we've done pretty well since then.

More ways of looking at information: The one thing that we have learned over the years is that there is not one single way that people actually are looking for information. That's a very, very important point. There's different use cases. There's very different user behaviors.

1) If you take a look at the core Search product, Search is very much about information retrieval. Search is very much about factuality. It's very much about freshness. It's very much about accessing the diversity of the web directly. And we fundamentally believe that all of this can be dramatically enhanced with new features of AI or Generative AI, and we see some of this already in our current experiments on SGE where we're getting very positive user feedback, as we mentioned before.

2) You look at another approach, so not the Search approach, but you look at something like a more chat style interface, it seems to be more centered at the moment around use cases such as creation, ideation, coding, and obviously, we can see a world emerging with the technology developing where there's more and different use cases that can be met by those type of interfaces.

People should see it as a growth opportunity: But the reality is, that's where we are today, and what's interesting about it is that GenAI overall actually provides a really interesting opportunity for growth, because we can actually expand the type of use cases that we can serve. Obviously, we can serve existing use cases better, but we can also significantly expand the type of use cases. And we're seeing some of those emerging already. You look at SGE and some of the early feedback on SGE. We know that users find it more helpful, for example, for more complex queries, for longer queries. Think about more comparison type of queries. We see that users find it very helpful for queries that require deeper insights. Sometimes you see those in the education sector. And also, keep in mind, we have gone through our fair share of platform shifts before, and we actually know how to manage them.”

4) On whether Search activity is impacted by the entrance of ChatGPT:

“So, let's be very clear. We're seeing positive Search query growth in all of our major markets, and this has been consistent over the last 12 months. Let's say, going back all the way to the end of February of this year, actually, rolling back 12 months. What's also really interesting to see, and you might have heard this metric before, that roughly 15% of all queries we see every day are new. We've never seen them before. And it's actually not that easy to get freshness right. And it's probably a testament to all the investment into Search and the infrastructure and the incredible talent that we have there, that we're actually delivering quite impressive results here. So those are all important points. Keep in mind, Search is so much more than just ten blue links or simply a chatbot. If you look at all the innovation that has gone into Search the past decade…. And just in the recent years, you look at -- let's start with maybe the BERT innovation in 2019, the BERT model. Then followed by the MUM models, I think that was in 2021 roughly going back.

Innovating around Search vertical:

Look at how we have really improved the way people can interact with Search in a much more multimodal way. Even pretty recently, you look at something like Lens, which has billions of searches a month at the moment. Really quite impressive, I feel.

You look at the ability to actually now question Lens. We introduced this with Multisearch where you can actually go and take a picture, and then you can ask a question about the picture, and GenAI will give you a very, very good answer back to this.

You look at what we have introduced with, let's say, Circle to Search. I'm not sure if you're on Android or you've used this already, where you can basically on any app, any picture, whatever you look at, you can just take your finger and circle it, and then you search for it, and then you can also invoke the Multisearch and ask questions about it with very high quality answers.

So there's a lot of really exciting things happening there. And we'll just continue to take Search as a product to the next level with all those new technologies that we have at our hands now.”

Another perspective is to assess periods in the past where Alphabet previously were challenged by competitors; Google has faced several challenges from competitors throughout its history, leading to moments of uncertainty reflected in its stock price. Some notable examples include:

The Rise of Facebook and Social Search:

In the late 2000s and early 2010s, the rapid ascent of Facebook introduced a new form of competition in the advertising and search spaces. With Facebook amassing a vast user base and collecting a rich dataset on user preferences and behaviors, there were concerns about Google's ability to maintain its advertising dominance. This was particularly pronounced with the introduction of Facebook's Graph Search in 2013, posing a potential threat to Google's search business.

Microsoft's Bing Launch:

In 2009, Microsoft launched Bing, a significant revamp of its search engine technology, aiming to directly compete with Google. Bing's launch, combined with a partnership with Yahoo to power Yahoo Search, caused concerns about Google's market share in search. The competition was intensified by Microsoft's marketing efforts and Bing's integration into Microsoft products.

The Mobile Revolution and Apple's Siri:

The shift towards mobile internet use and the introduction of Apple's Siri, a voice-activated assistant, in 2011, presented a new form of search competition. Siri's ability to process natural language queries and provide direct answers without a traditional search engine interface posed a conceptual challenge to Google's search dominance. This period saw heightened concerns about Google's ability to transition its search and advertising models to the mobile-first world.